Too many individuals believe that wills and estate plans are only for those who have more wealth or heirs, run their own businesses, or take holidays in second homes.

However, as a lawyer, my advice is that the best time to start an estate plan, regardless of your net worth and assets, is now.

There is no set age when you should start considering estate planning. If you pass away without a plan in place, the government will decide who gets your belongings after a protracted and costly probate process.

A simple will can ease future tension for your family members and offer them confidence that they are carrying out your instructions.

This guide covers what to know about when to begin estate planning, including:

When is an estate plan required?

What happens to my assets when I’m gone?

When should I name a guardian?

When should I change my estate plan?

When Is an Estate Plan Required?

Many financial consultants advise that an estate plan is required as soon as you reach legal adulthood and to update it every 3 to 5 years afterward.

This is because you are now legally responsible for your money, healthcare (in some areas), and power of attorney at 18. You want to ensure that everything is in order regularly.

What Exactly Is an Estate Plan?

Estate planning entails the creation of several documents that will not only have a significant impact on you while you are alive but also on what happens after your death.

Most people know that a will, which specifies how your possessions and assets are distributed after your death, is a component of an estate plan.

A will also allows you to choose the executor who will take care of your business after your passing and name a guardian for your minor children.

Other legal documents that you might require at any time, without warning, are included in an estate plan. An advance directive, also called a living will, outlines your preferences for medical care, including life support and feeding tubes, should you become incapacitated.

Related: Do Wills Expire? 6 Things To Know

What Happens to My Assets When I’m Gone?

The departed person's estate must pay all unpaid obligations. Assets belong to the estate of the deceased when they die.

Probate is the process of settling all of your debts after you pass away and distributing any remaining assets from your estate to your heirs.

Your state's intestacy law decides who gets your possessions if you don't make a will.

Your entire estate normally goes to the state if no relatives can be located. This applies to IRAs, retirement funds, and bank accounts.

Probate is the process of settling all of your debts after you pass away and distributing any remaining assets from your estate to your heirs.

When to Name a Guardian

It is always a good idea to start considering who you would name as your first child's guardian if something unexpected happened to you.

Although most new parents prefer not to think about this, it is important to put it in writing.

Usually, when you write a will, you designate a guardian.

It's critical to keep in mind that every time you have a new baby, this paperwork needs to be updated.

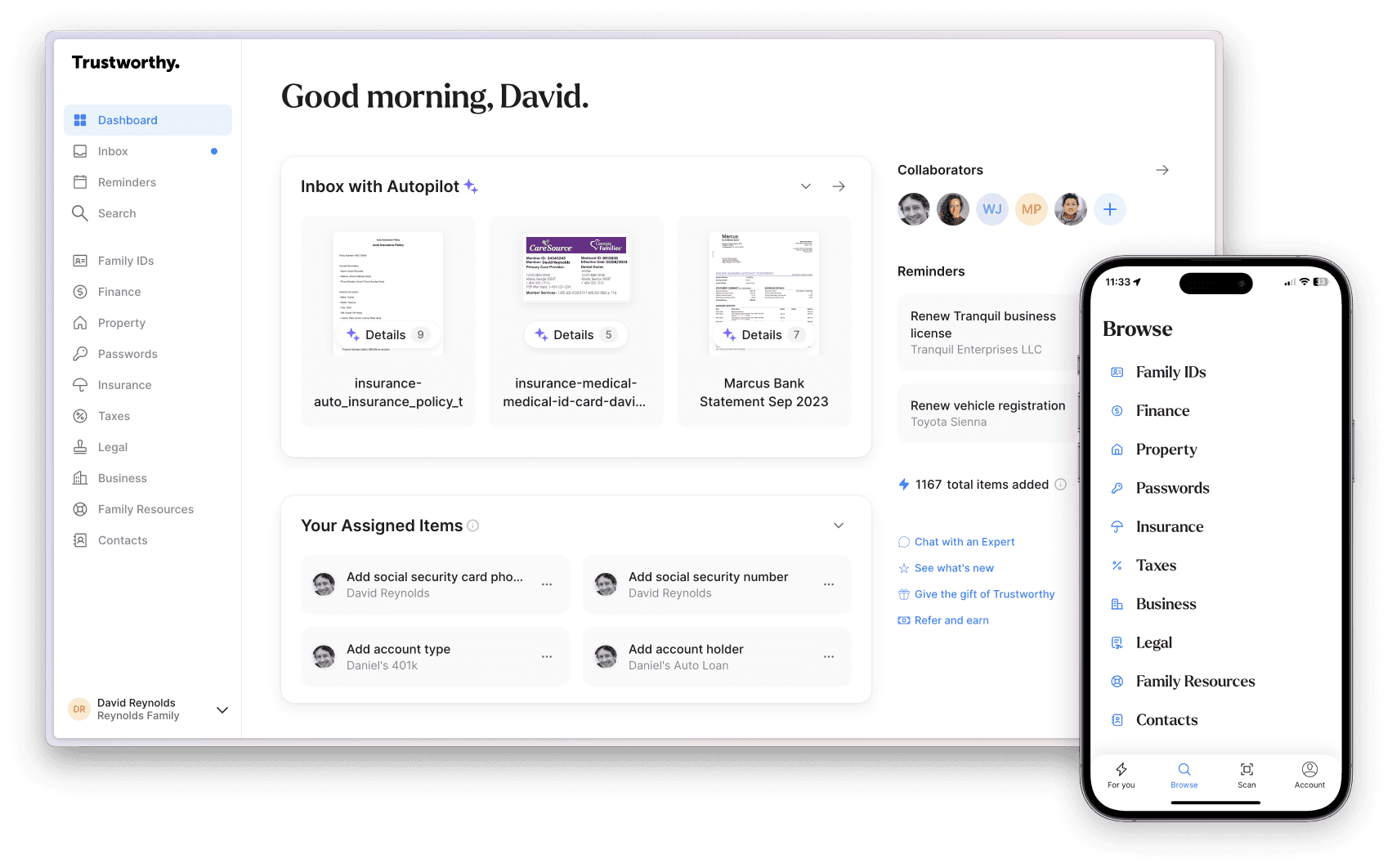

Trustworthy can help you with this process. You can access, share, and modify your documents by simply signing into your account.

When to Draft a Will

As soon as you attain legal adulthood is the optimal time to prepare a will. Unfortunately, many people in America die without leaving a will.

Family members are left dealing with death while also being in charge of many choices they might not have thought about. Drafting a will can help you avoid this scenario by allowing you to designate how your investments and finances will be allocated.

When to Make a Trust

It might be appropriate to form your trust if you have important assets, such as real estate or other assets.

Trusts can help you avoid probate and give you more authority over how your assets are dispersed during your lifetime and after your passing.

Additionally, setting up a trust helps you avoid extra taxes or charges as your assets are distributed to different beneficiaries.

Creating a Power of Attorney

When you cannot manage your finances, such as paying your bills and managing your money, a power of attorney allows someone else to do so on your behalf.

If you cannot make decisions for yourself, these documents allow you to control what happens to you and your affairs throughout your life.

When to Change Your Estate Plan

Experts advise reviewing your estate plan every 3 to 5 years or anytime there is a significant change in your life.

The following life events typically indicate that your estate plan needs to be updated.

The Arrival of Children

To ensure that your children have a legal guardian in place and will have financial security after your passing, they must be accurately represented in your will (or trust).

Additionally, updating your documentation is crucial whenever new family members (often grandkids) are born who you want to identify as beneficiaries.

Marriage & Remarriage

Marriage frequently results in shared property ownership between husband and wife and can occasionally result in the drafting of joint trusts or joint wills.

You must amend your documentation when assets are no longer shared with a previous spouse.

Before Traveling

It is advised to update your estate plan before significant travel, especially if you frequently leave the country or travel extensively.

If anything were to happen to you while traveling abroad, you’d want to have your affairs in order.

After Inheriting Money or Other Assets

If applicable, update your will (and any trusts) if you unexpectedly acquire new property or funds that raise your estate's value to ensure everything is covered.

Probate Concerns

Having an estate plan will help you cut down on the probate process' delays, costs, and privacy invasions. The following issues with probate include:

Privacy loss: The probate court is open to the public. For instance, family members and creditors might obtain your probate papers to contest your will.

Cost: Probate costs can be expensive, even in the simplest scenarios. Up to 5% of the assets of an estate may be required to cover legal fees and court costs.

Delays: An uncontested probate, on average, could take more than one year. These hold-ups, expenses, and invasions of privacy can frequently be avoided with careful planning.

Preparing for Incapacity

Estate planning is sometimes viewed as a process that must be completed to prepare for what will occur after your death. However, documentation in the event of your incapacity is a crucial element of estate planning.

If you cannot handle your financial affairs on your own, you can designate someone with the use of a financial power of attorney. This can go into action immediately after you sign it, or it can "spring," which means it takes effect after you become incapable.

Be sure to inquire about any policies or restrictions your financial services provider may have about the acceptance of springing powers of attorney.

A living will, HIPAA authorization (a detailed document that ensures the privacy of your medical records), and power of attorney for health care (sometimes referred to as a "health care proxy") are all documents that allow someone to make medical decisions on your behalf.

Consider hiring an attorney to draft these documents if you don't already have them. If the first person you designate cannot serve, you may want to name a backup.

If you already have these documents, review them to make sure the person(s) identified on them still sits well with you, and work with your lawyer to ensure they are up to date and correctly reflect your wishes.

Charitable Goals

There are many ways to include charitable goals in an estate plan if the estate has significant assets and the owner wants to donate to charity.

Even though charities can be listed as beneficiaries, it may be more advantageous from a tax standpoint to leave the charity non-Roth IRA assets and assets that pass through your will to specific people.

From a tax viewpoint, designating your preferred trust or charity as a primary or contingent beneficiary may be more advantageous. You may designate a particular portion of your retirement plan assets to go to charity, for instance.

Or, if you want to create a lifetime income stream for a charity, consider creating a charitable lead trust (CLT). If the CLT were correctly constructed, the balance would be distributed to the grantor's beneficiaries after termination.

The beneficiaries of a properly drafted charitable remainder trust (CRT) would receive an income stream. In contrast, the grantor (who founded the trust) is still alive, with the remaining assets going to the grantor's preferred charity.

Both CLT and CRT have several advantages, some of which include the following:

Lowering or eliminating capital gains taxes on appreciated assets

Claiming charitable contributions as income tax deductions

Lowering the estate tax

Donating to your preferred cause

You can sort through the possibilities that might be ideal for you with an attorney or tax expert.

Business Succession

Have you thought about how to plan for your business after your passing?

If you intend to retain it inside the family, think about setting up a structure that will make it simpler for family members to inherit the company's assets, like a family limited partnership or a family limited liability corporation.

There are a lot of choices. Your lawyer or tax expert can assist you in making the best choice for you, given your circumstances.

Families with Special Needs

Concerning disabilities, particular trusts are established for a beneficiary who is disabled, organized in a way that permits the beneficiary to continue to be eligible for government benefits like Social Security Disability Insurance.

Once more, a lawyer can assist in creating a trust that will suit your unique circumstances.

Start Estate Planning as Soon as Possible

Many professionals advise making an estate plan as soon as you reach legal adulthood and updating it periodically (or whenever you encounter major life changes).

An overview of estate planning by age is provided here:

In Your 20s and 30s

In their 20s and 30s, nobody wants to think about dying, but you should prepare for the unexpected.

Even though it seems implausible, it's a good idea to put your affairs in order in case the unthinkable happens.

Since your estate plan will probably be relatively straightforward, there's no need to spend a lot of money on it now. This strategy can be updated as your affairs become more intricate.

During this time, think about drafting the following documents as part of your estate plan (they are necessary regardless of your wealth or assets):

Healthcare power of attorney: Having a Healthcare POA in place assures that someone you trust will have the legal ability to make these decisions on your behalf if you become incapacitated and unable to make them for yourself.

Durable power of attorney: A durable power of attorney will give someone you trust the legal power to handle your personal affairs, make payments on your behalf, and speak on your behalf if you become incapacitated.

Will: If you have kids, you should have a will since it enables you to designate a guardian for your minor kids. A will also allows you to give your property to unmarried partners who would not otherwise be eligible for an inheritance.

Living will: If you become mentally incompetent, a living will enables you to specify your intentions for your medical care. This is different from a healthcare POA, which gives someone else the authority to make decisions for you. If you are diagnosed with a fatal illness or become incompetent, a living will comes into play to ensure your wishes are honored.

In Your 40s

The same documents are equally crucial when you approach your 40s. Your circumstances may now be more complicated, and your desires may have altered.

For instance, you might want to update your power of attorney or modify who your children's legal guardian is. You should update this paperwork in your 40s.

Additionally, consider creating a trust if you amass more assets. Using a trust, you can exert more influence over how your assets are distributed.

A trust can enable you to include conditions like the requirement that your children use their inheritance money for educational costs or the ability to decide when they receive it.

Additionally, creating a trust will help you avoid probate.

In Your 50s and 60s

By the time you reach 50 or 60, you won't be overly concerned if you start estate planning in your 20s. Considering your present health conditions and age, reviewing some of your estate planning documents that pertain to your healthcare may be wise.

It's a good idea to review your living will and any existing powers of attorney to ensure they still accurately reflect your objectives.

It's never too late to start estate planning if you didn't do so while you were in your 20s. If you haven't already, getting the aforementioned papers organized at this time in your life is more crucial than ever.

Share Your Wishes and Estate Plan through Trustworthy

One of the most crucial steps you can take to safeguard yourself, your family, and your future is estate planning.

Trustworthy makes it easy to share your will or update your final intentions.

It's a good idea to share your estate planning documents as soon as one of the milestones listed above approaches.

Trustworthy gives you and your family a streamlined place to review and revisit your estate planning documents when your situation changes for better or for worse.

It's best to prepare for the unexpected and ensure your estate plan is in the right hands as soon as possible.

Try Trustworthy free today.

Related Articles

We’d love to hear from you! Feel free to email us with any questions, comments, or suggestions for future article topics.

Trustworthy is an online service providing legal forms and information. We are not a law firm and do not provide legal advice.