Managing your family’s essential information doesn’t have to be overwhelming. With Trustworthy’s Family Operating System®, you can organize and safeguard your most important documents with ease. Here are five practical tips to help you set up your Trustworthy account and enjoy greater peace of mind.

Take small, consistent steps. You don’t need to organize everything in one day. Start with the essentials, and Trustworthy’s features, including automated reminders and smart guidance, will help you build a secure, organized digital vault over time.

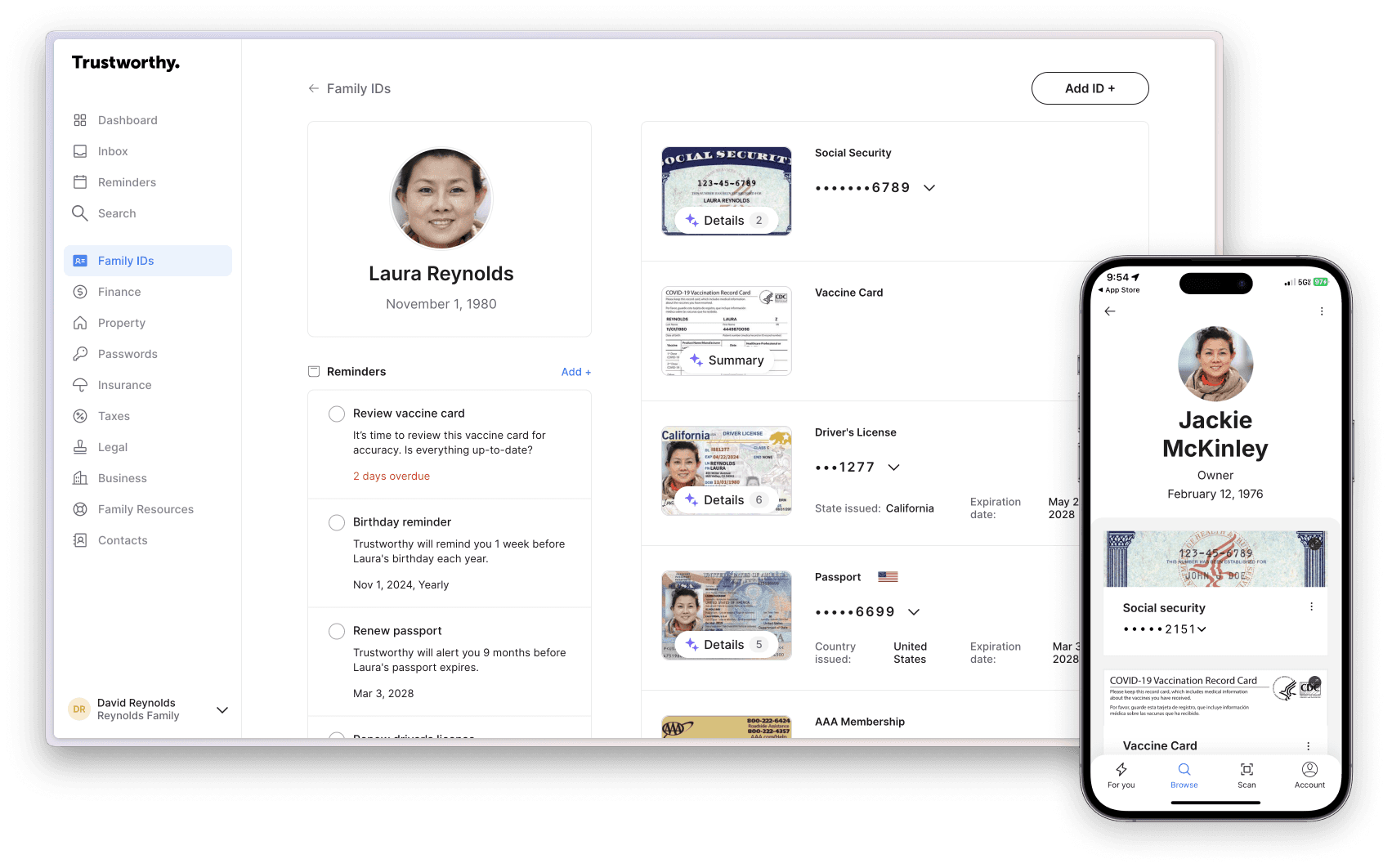

Tip No. 1: Start With Family IDs and Personal Documents

Starting with Trustworthy is easy when you gather your most important documents and details in advance. Focus first on key files and information your family may need for everyday use or during emergencies.

Here’s a checklist of information to collect, now or a bit later:

Family IDs:

Driver’s licenses.

Passports.

Birth certificates.

Social Security cards.

Medical information:

Insurance cards.

Vaccination records.

Advance directives or medical power of attorney documents.

Financial records:

Bank account and investment details.

Tax returns and supporting documents.

Property records:

Deeds and mortgage documents.

Vehicle titles or leases.

Home improvement or maintenance records.

Insurance policies:

Health, life, home, auto, and other insurance policies.

Claims documentation.

Legal documents:

Wills and trust documents.

Power of attorney agreements.

Emergency information:

Contact details for family members and emergency services.

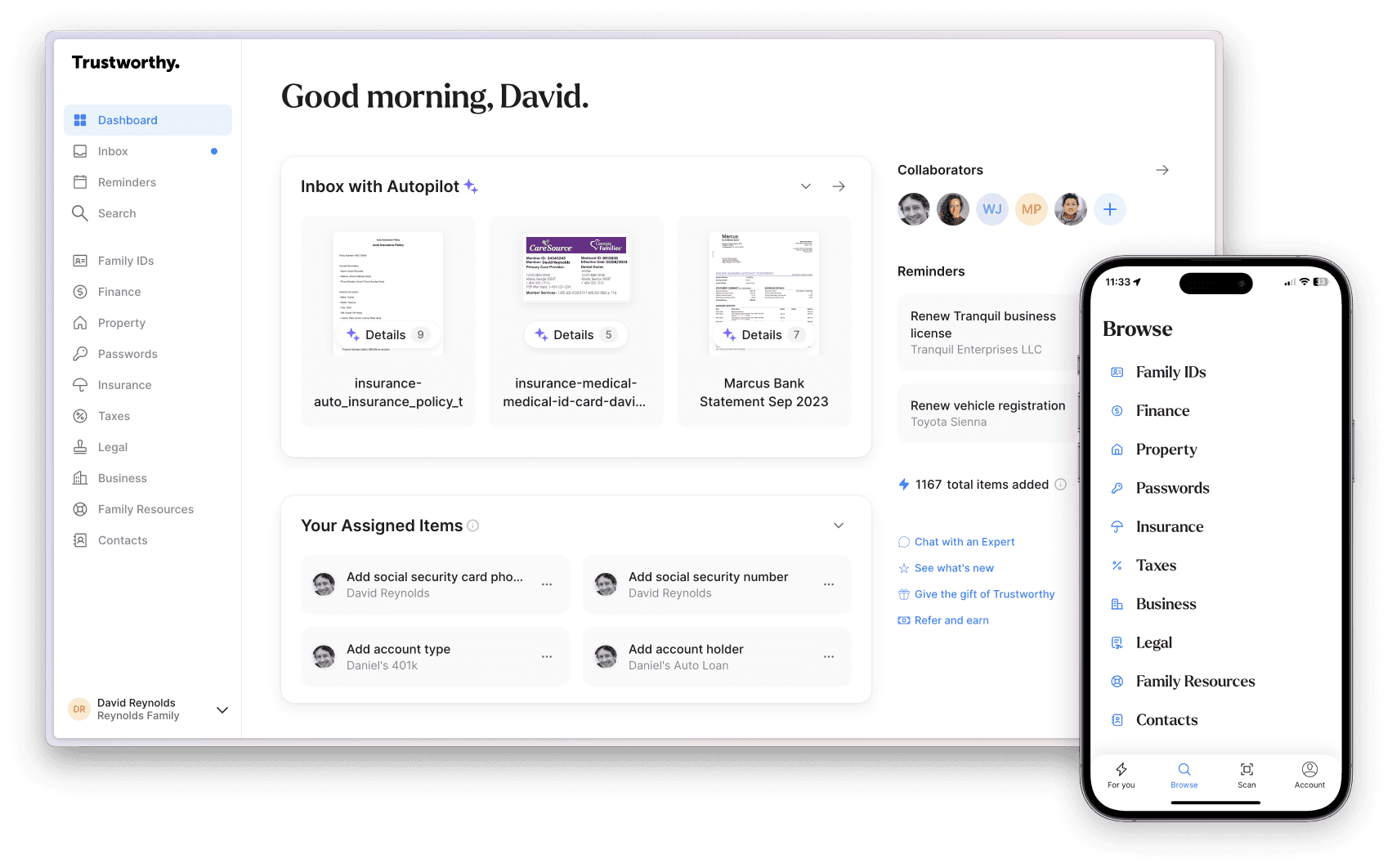

Tip No. 2: Use Inbox and Autopilot for Effortless Organization

Streamline your document management with Trustworthy’s Inbox features, including Autopilot. Trustworthy provides multiple avenues for adding files to your Inbox:

Bulk uploading from your desktop: Easily drag and drop multiple files from your desktop.

Scanning: Use Trustworthy’s mobile app or a Ricoh ScanSnap scanner to upload paper documents directly to your Family Operating System®.

Email to Inbox feature: Forward emails with attachments straight to your Trustworthy Inbox.

Chrome extension: Capture screenshots and Gmail attachments with a single click.

Once your files are in your Trustworthy Inbox, Autopilot takes over by analyzing your uploads, offering helpful file name suggestions, generating summaries, extracting key details, and auto-filling relevant fields. Essentially, Autopilot takes the guesswork out of document management, allowing you to focus on more important tasks.

Here’s the magic of Autopilot in more detail:

Compiling details: Autopilot quickly analyzes uploaded files, suggesting actions and extracting essential details like names, account numbers, and policy information. It can even auto-fill fields such as driver’s license numbers and insurance policy data.

Suggesting document locations: When Autopilot identifies the ideal existing location for a document, it prompts you to move it. For example, if you have uploaded an ID card, Autopilot will suggest moving it to the family IDs section automatically.

Creating file summaries: Helpful summaries simplify understanding long and complex documents like trusts or wills.

Renaming files: Autopilot can suggest more meaningful file names, such as changing "Sent from Xerox 2123" to a more descriptive title.

Tip No. 3: Share Access With Family and Trusted Professionals

Don’t wait, collaborate! Collaboration unlocks Trustworthy’s full potential from the moment you upload your first document.

Whether you’re teaming up with a spouse, inviting your adult children, or working with trusted advisors like attorneys or financial planners, adding collaborators early simplifies life for everyone. There’s no need to wait until you’re done.

You control how much access your collaborators get:

Full access: Collaborators can view and edit all items and categories, as well as manage access, manage the plan, and change settings. This is ideal for key family members involved in financial or household management.

Partial access: This lets collaborators view and edit only specific categories. They can’t manage access, the plan, or settings. This level of access is great for working with advisors or professionals.

Legacy access: Collaborators have no account access now but may request full access in the event of your passing, pending identity and death certificate verification. This access level is a perfect option for estate planning.

Collaboration creates immediate benefits by keeping your family connected and informed during routine and critical moments.

Learn more about collaborating with your family and trusted professionals.

Tip No. 4: Stay Connected on the Go

Trustworthy’s mobile app keeps your Family Operating System® at your fingertips, making it easy to manage your family’s essential information anytime, anywhere.

Whether you need to pull up an insurance card at a doctor’s office or scan and upload a new document on the spot, the mobile app has you covered. The mobile app mirrors the full capabilities of the web app, so anything you can do on your computer, you can do from your phone, including:

Upload documents: Use your phone’s camera to scan and upload items like receipts, contracts, or medical forms instantly.

Access information quickly: Whether you need to review mortgage details, an insurance policy, or a child’s vaccination records, all of your information is just a tap away.

Set reminders: Stay on top of deadlines, renewals, and tasks by creating reminders directly in the app.

Collaborate seamlessly: Add collaborators, adjust permissions, or share files securely right from your device.

Tip No. 5: Get Personalized Help From Trustworthy Certified Experts™

For a tailored experience, connect with a Trustworthy Certified Expert™. Whether you’re time-starved or have a loved one who needs assistance, our Experts can help with:

Digitizing information: converting documents, notes, and other items into secure digital formats.

Preparing for emergencies: compiling contact lists, medical directives, and insurance policies for quick, reliable access when needed.

Inviting collaborators: setting up trusted individuals with appropriate access to your family’s critical information, now or in the future.

Sharing with advisors: collaborating with wealth advisors, accountants, and estate planning attorneys to keep your plans on track.

Preserving memories: capturing family stories, heirlooms, and mementos to ensure your history is preserved for future generations.

Documenting operations: detailing household operations, such as how to manage bills, schedules, or unique family routines.

Trustworthy Certified Experts™ guide you through setup, help upload key documents, and provide personalized advice on using your account effectively.

With these tips, your Trustworthy account can transform how you manage your family’s life. From staying ahead of deadlines to collaborating effortlessly, Trustworthy is your partner in creating an organized, secure, and stress-free household.

Ready to get started? Log in now and take your first steps toward a more organized future.

We’d love to hear from you! Feel free to email us with any questions, comments, or suggestions for future article topics.

Trustworthy is an online service providing legal forms and information. We are not a law firm and do not provide legal advice.