We all want to see our parents age happily and comfortably. But to safeguard that comfort and happiness, you might reach a point in which it’s necessary to step in and take control of their finances.

Elderly individuals are more likely to be targeted by financial scammers, and your parents’ household wealth could be drastically affected by poor decisions related to cognitive decline. You don’t want them to become a statistic or stumble into financial problems.

However, it can be incredibly difficult to breach “the conversation” with elderly parents — and taking on the finances of other people might feel a bit daunting, too.

To help you get started, we sat down for a Q&A session with Alfred Polizzotto, managing partner of Brooklyn-based law firm Polizzotto & Polizzotto.

With more than 33 years’ worth of experience practicing law, one of Polizzotto’s special areas of expertise is elder law — guiding clients and their families through crucial processes like setting up powers of attorney, creating and managing trusts, creating advance directives, and more.

Read on to get his pro tips and discover new strategies to breach tricky conversations, find out how to get professional support, and learn why you should work with siblings and other family members to manage your parents’ finances.

What Are Signs It’s Time to Take Over Your Parents’ Finances?

Answer: If you see unopened bills piling up or hear about calls from creditors, it's usually a sign for intervention. Cognitive decline can sneak up on seniors, and you don’t want to wait until something serious happens.

Another sign is if your parents make unusual purchases or seem forgetful about money. I’ve seen too many cases where parents were scammed out of thousands because their kids didn’t step in soon enough.

How Should You Approach 'the Conversation' About Taking Control of Parents’ Finances?

Answer: Ask open-ended questions like, “How are you managing your bills?” or “Is there anything I can help you take care of?”

You don't want to come off as controlling but as someone who cares. When you frame it as a partnership rather than a takeover, they'll be less resistant to your efforts.

What Are the Key Documents You’ll Need to Manage Your Parents' Finances?

Answer: Bank statements, credit card statements, and any loan documents. Don’t forget tax returns from the last few years, as they’ll give you a good picture of income and deductions.

You’ll also want insurance policies (health, life, and property) and any wills or trusts they may have set up. If they have investments, get access to those account statements as well.

How Do You Set Up A Power of Attorney for Financial Decisions?

Answer: The first thing to do is talk to your parents about why a power of attorney is important. The entire goal here is protecting their interests and ensuring their bills are paid on time if they can’t manage it themselves. Do this while your parents are still able to understand what it means.

The next step is getting in touch with an attorney who specializes in elder law. They can help draft the document according to your state’s laws.

It’s usually a straightforward process where your parents will need to sign the power of attorney in front of a notary.

How Should You Organize Your Parents’ Bills and Accounts?

Answer: I recommend setting up a simple and straightforward system — maybe using a binder or an app where you can keep track of everything in one spot.

Break it down into sections for monthly bills, insurance info, bank statements, etc. Set up automatic payments for recurring bills to avoid late fees and stress.

It’s great if you can sit down with your parents to review everything together regularly. It only goes to reinforce that you want to keep them involved and catch any discrepancies early on.

How Can You Create a Budget for Managing Your Parents' Expenses?

Answer: First, list all their income sources, including pensions, Social Security, and any side gigs they might have. Then, break down their expenses into needs and wants.

Their budget needs to accurately reflect “their” lifestyle, not the one you think they need. It needs to cover everything from necessities like healthcare and housing costs to passions and hobbies they’re drawn to.

Healthcare costs should be at the top because those can sneak up on you — and nobody wants to be in a situation where they can’t afford their medications.

I also suggest setting aside a little “fun money” for them each month. They’ve worked hard for their money, and they deserve to enjoy it.

What Do You Need to Know About Managing Your Parents’ Investments?

Answer: Ask them how comfortable they are with risk and what their financial goals are. If they’re invested in stocks, for example, it might be time to discuss shifting some funds into safer options as they age.

And if you’re not comfortable managing investments yourself, bring in a financial advisor who specializes in elder care.

How Can You Protect Elderly Parents From Financial Scams?

Answer: Open conversations are the best. I have clients who sit down with their parents and watch YouTube videos about fake calls from the IRS or phishing emails claiming they've won a prize.

Exposing them to what’s happening in the world makes them more likely to take you seriously when you encourage them to be skeptical of unsolicited offers or phone calls.

You could also set up a “trusted contact” system where your parents can run any suspicious calls or emails by you before taking action.

How Can You Involve Family Members in Your Parents’ Finances?

Answer: The best thing to do is to have a family meeting early on and discuss your parents' financial situation. Everyone should have a voice in this conversation, even if it gets a bit emotional.

The good thing here is that you’re not alone, and every sibling can take on a different role. Someone could handle day-to-day expenses, while another could manage investments, etc.

When Is it Time to Hire a Financial Advisor or Elder Law Attorney?

Answer: If you’re feeling overwhelmed or if your parents’ finances are complex, like if there are trusts involved or multiple investment accounts, it’s just better to get help.

Ideally, you want an advisor who specializes in elder care because they're adept at navigating the challenges seniors face.

As for elder law attorneys, ask about their experience with similar cases and get references from other families they've helped.

––––––––––––––––––––––––––––––––––––––––––––––––––

How Trustworthy Can Help You Ease the Transition

Taking on your parents’ finances can be a messy and complicated process. That’s where a platform like Trustworthy can offer essential support and streamline the process.

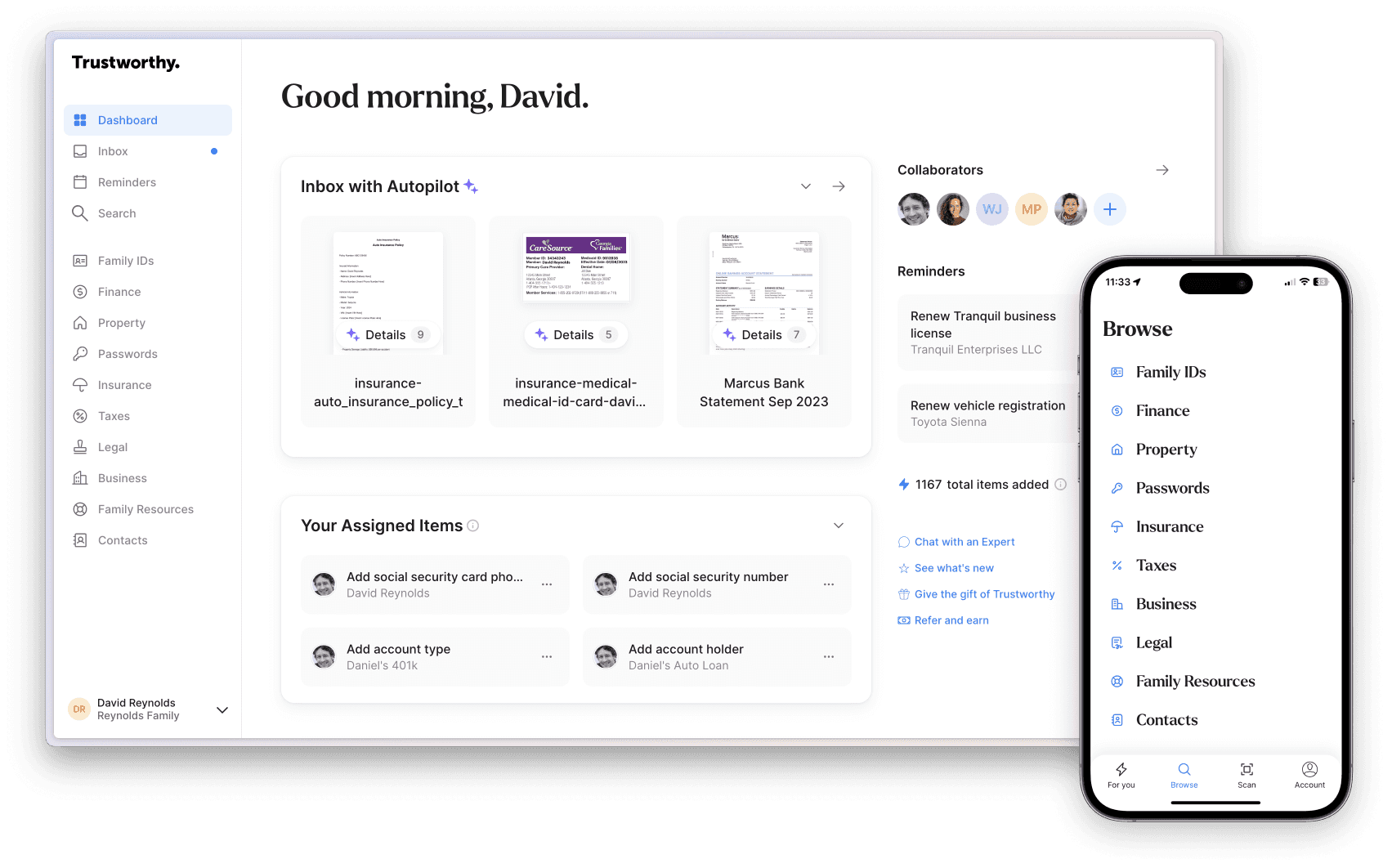

Trustworthy’s Family Operating System® enables families to upload essential family documents and create secure digital versions. Everything your family uploads to Trustworthy is kept under lock and key with bank-level AES 256-bit encryption — but its collaborative and organizational features make sharing financial documents safe and easy.

That means both you and your parents will be able to access essential documents whenever (or wherever) required. However, you can also grant granular access to your parents’ attorney or financial advisor to collaborate and guarantee everyone is on the same page when it comes to their accounts.

Meanwhile, Trustworthy’s AI-powered Autopilot tool helps you to organize and categorize your parents’ financial information — and Trustworthy even sends you automated prompts when insurance policies, IDs, or other documents are up for renewal.

Ready to learn more? Find out how Trustworthy can help you collaborate with your parents to manage their finances.

We’d love to hear from you! Feel free to email us with any questions, comments, or suggestions for future article topics.

Trustworthy is an online service providing legal forms and information. We are not a law firm and do not provide legal advice.