Life is unpredictable, which is why it's essential to protect your family from unexpected challenges.

Unfortunately, many people aren't as prepared as they'd like to be. Fewer than a third of Americans have written a will, and only about a quarter have an estate plan.

It's no wonder — getting organized and planning for the future can feel overwhelming. But starting the process now can spare your loved ones unnecessary stress down the road.

To help you make sense of that process, we sat down for a Q&A session with Kalim Khan, a senior partner and founder of Toronto-based firm Affinity Law. With over two decades of experience in estate planning, Khan’s law firm helps guide families through complex legal decisions and supports them in organizing and securing their legal documents.

In addition to helping individuals fulfill a range of estate planning and documentation requirements, Affinity Law offers specialist services to various communities, including Sharia-compliant wills and powers of attorney.

Read on to get Khan’s take on the importance of organizing legal documents, best practices for document storage, how to avoid common mistakes throughout the estate planning process, and when you should seek professional help getting your legal documents in order.

Why Is It So Important to Organize Legal Documents?

Answer: Organizing documents ensures your wishes are clear and enforceable while minimizing delays, disputes, and emotional stress for your loved ones during critical times.

Disorganized or inaccessible documents can lead to probate delays, disputes over asset distribution, and invalid legal instruments, leaving your estate vulnerable.

What Are the Best Practices for Storing Legal Documents?

Answer: Originals should be stored in a fireproof safe, safety deposit box, or with your attorney. These locations protect against damage while keeping documents accessible to designated parties.

Physical copies are legally required for most purposes, but digital versions serve as vital backups for quick access in emergencies.

Fireproof safes offer accessibility but may lack theft protection. Safety deposit boxes are secure but can restrict access. Digital vaults provide convenient sharing and backups but require strong cybersecurity measures.

What Legal Documents Are Needed for Estate Planning?

Answer: Wills, living trusts, powers of attorney, and advance healthcare directives are essential, ensuring financial, medical, and legal decisions align with your intentions.

A will governs asset distribution after death, a trust manages assets during life and beyond, and powers of attorney authorize decision-making during incapacity. Each addresses distinct needs.

Documents like beneficiary designations, guardianship plans for minors, and funeral directives are often overlooked but critical for a comprehensive estate plan.

How Often Should You Update Estate Planning Documents?

Answer: Review every three to five years or after significant life events to ensure accuracy and relevance.

Marriage, divorce, childbirth, acquiring significant assets, or the death of a beneficiary are common triggers for updates.

What Are the Legal Requirements to Consider?

Answer: Requirements such as notarization, witness criteria, and execution formalities vary by state. Consulting a local attorney ensures compliance.

Working with a qualified attorney during drafting and execution guarantees that documents meet statutory requirements and withstand legal challenges.

What Are Common Estate Planning Mistakes?

Answer: The most common mistakes people make when organizing legal documents are failing to update documents, not informing family members of their location, and neglecting to address minor details. This can lead to complications.

You can avoid losing important documents over time by using secure physical storage, periodic reviews, and digital backups to ensure documents remain safe and accessible over the years.

What Role Does Technology Have to Play in Document Organization?

Answer: Digital tools are invaluable for organization and accessibility, provided robust encryption and cybersecurity measures are in place.

Platforms like Trustworthy are excellent for secure digital storage and sharing.

Who Should Have Access to Estate Planning Documents?

Answer: Executors, trusted family members, and attorneys should have access. Clearly communicated access protocols ensure security and availability.

So that individuals know where to find these documents, create an inventory, and share it with executors and key family members, ensuring clarity and preparedness.

What Advice Do You Have for First-Time Organizers?

Answer: Begin by listing all essential documents, gather originals, and consult an attorney for guidance. Use templates or checklists to streamline the process.

Use organizational tools like Trustworthy's guides or simple estate planning checklists to structure your approach effectively.

When Should Individuals Get Professional Support?

Answer: You should engage professionals when drafting, after major life changes, or when dealing with complex assets or family structures.

Professionals provide tailored advice, ensure compliance with evolving laws, and address complexities, offering peace of mind that DIY solutions simply cannot guarantee.

–––––––––––––––––––––––––––––––––––––

Streamline the Organization Process With Trustworthy

Even if you’re working with an attorney or an estate planning expert to get your legal documents in order, the process of establishing an ironclad organizational strategy can be daunting.

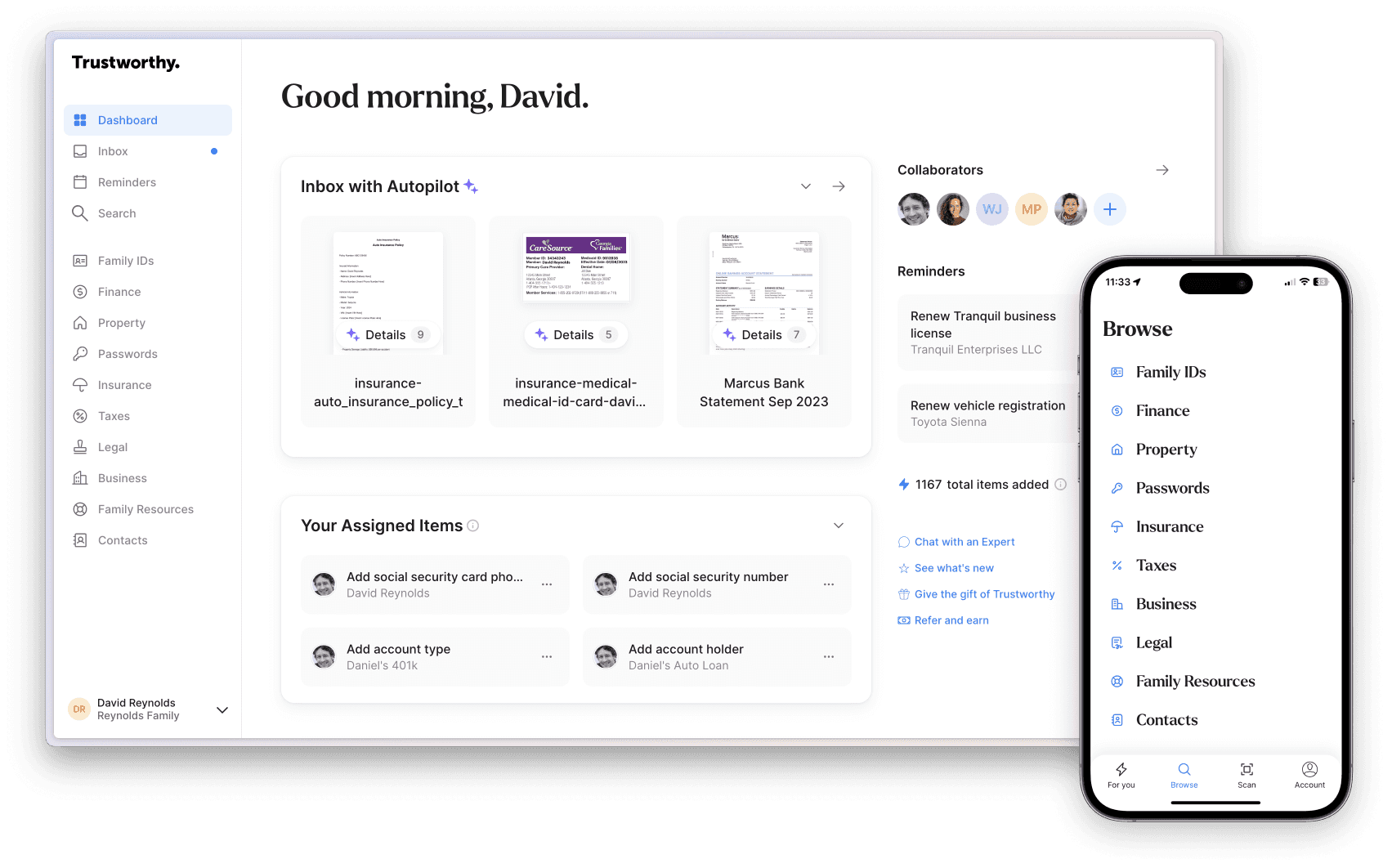

That’s where Trustworthy can step in to help you streamline the process. Trustworthy’s dynamic Family Operating System® enables you to upload and create digital versions of your important family documents, including estate planning essentials, family passports, insurance policies, and the deed to your family home.

And with Trustworthy’s AI-powered Autopilot tool, the process of digitizing those household essentials couldn’t be easier. It offers file name suggestions, tells you how to categorize each document, and generates automated summaries of long documents so you don’t have to skim through every page to figure out what you’re dealing with.

After categorizing your family’s essential documents, Trustworthy sends auto reminders when paperwork needs to be reviewed. For example, you’ll get a prompt when an insurance policy is nearing its expiration date. You can also set manual reminders to ensure you review your estate planning documents on a regular cycle..

Everything you upload to your digital vault is protected by bank-level security — including robust password recipes, two-factor authentication (including hardware keys), and AES 256-bit encryption. However, you can also share secure, granular access to various documents to ensure family members and trusted professionals can access documents when required.

So, are you ready to get organized? Take a look at Trustworthy’s range of features to discover how it can help you simplify the process.

We’d love to hear from you! Feel free to email us with any questions, comments, or suggestions for future article topics.

Trustworthy is an online service providing legal forms and information. We are not a law firm and do not provide legal advice.