You’ve probably heard that safety deposit boxes are a great place to store your valuables, but how much do they cost?

Safety deposit boxes vary in price based on the bank you choose and the box’s location. You can expect to pay anywhere between $80 and $200 annually for standard-sized safety deposit boxes.

Below, you’ll learn how much it normally costs to lease a safety deposit box, and whether or not it’s the right decision for your valuables. I’ll also break down the different factors that influence the price of safety deposit boxes.

Key Takeaways

The safety deposit box cost starts from as little as $42 per year and comes with drilling fees starting from $100.

Safety deposit box fees will depend on the box size, the branch location, security features, and customer discounts.

The availability of safety deposit boxes is declining. The best alternative to bank safe deposit boxes is Trustworthy’s family digital vault.

Annual Fee for a Safety Deposit Box

Bank of America

Bank of America offers safety deposit boxes with prices based on box size. Unlike other banks like TD Bank, there are only two sizes available: 3” x 5,” which costs $75 annually, and a 10” x 10” box that costs $300 annually.

Make sure not to lose your key because drilling fees for safety deposit boxes are currently $150, and late payment fees of 30 days are $10. These fees are appreciable across all states.

If you lose your key, these can be replaced for between $10 and $25, depending on the type of safety deposit box you have and where the branch is located.

PNC Bank

PNC offers safety deposit boxes based on multiple levels of security for their account holders. They issue you a key and they hold on to a guard key to use simultaneously when you wish to access the contents inside. The annual rental fee will depend on the box size and branch location.

PNC Performance Select Checking Account holders might be eligible for a $100 annual discount for a safety deposit box, and Performance Checking Account holders can receive a 10% annual discount.

You can get two replacement keys for $15 and must pay the cost of the box if you need to drill into the lock. A standard $10 late fee is required if your payment is over 30 days past due.

TD Bank

TD has started offering safety deposit boxes in numerous branches across the country. Their smallest box will cost you $60 annually, which is quite cheap compared to other major banks in the US. However, they have a relatively hefty drilling fee of $200, should you misplace your key.

Unlike most banks, TD Bank also offers a super large safety deposit box priced at $5 per square inch.

Replacement keys for TD Bank safety deposit boxes start at $50. Account holders are also subject to a $5 late fee for overdue payments and a $5 annual billing fee notice.

Chase

Chase safety deposit boxes use both keys and a keypad for access. The smallest box available comes in at $55, with the large 10” x 10” costing $300 annually. You can pay a key deposit that will cover the cost of your replacement key, but you need to surrender the lease to Chase beforehand.

You’re also not allowed to store hard cash inside a Chase safety deposit box unless it’s as a collectible.

Regions Bank

Regions keeps all its safety deposit boxes inside their secure vault. They have numerous sizes available, with their smallest costing $57 per year. You can pay for your deposits using deductions from your checking account, via mail, or at Regions branch.

The drilling fee for opening your box is $150, and a replacement key will cost an additional $25. Clients that have or open a Regions checking or savings account can receive a discount ranging from 30 to 50% off the bank safety deposit box fees.

US Bank

US Bank has safety deposit boxes at several branches and offers 24/7 support for account holders. You can pay a small $10 fee for a replacement key and a $150 fee if you need to drill into the lock.

Clients with premium and pinnacle accounts can expect a 50% discount off the annual safety deposit box cost.

Wells Fargo

Wells Fargo offers leases for security deposit boxes starting at just $80 for their 3” x 5” units. These boxes are 3 inches high and 5 inches wide with 22 inches of depth for storing your items.

While you do get the security of the bank’s building, it’s important to know that your valuables aren’t insured by Wells Fargo or the Federal Deposit Insurance Corp.

If you need a replacement key, Wells Fargo charges $20 for two keys. If you need to drill into the lock of your safety deposit box, you’re required to pay a drilling fee of $125. If you need to drill into the deposit box with less than three business days' notice, you will have to pay a fee of $175. You’re also responsible for a $10 late fee if your payment is late beyond 60 days.

What Affects the Cost of Safety Deposit Boxes?

Here are some of the things that can dictate how much it costs to lease a safety deposit box:

The Bank You Choose

Every major bank prices their safety deposit box leasing fees differently. Banks have different price structures to cover their overhead costs, and their safety deposit boxes are one of the services that add to their revenue.

You’ll often find that banks in urban areas and banks with well-established reputations will charge higher fees. Some banks will offer discounts to existing account holders, like Regions Bank.

Location

Besides the bank you choose, the location of the branch that holds your safety deposit box can influence the cost. Branches in high-end neighborhoods will often have higher fees than those in rural areas. For example, a safety deposit box in New York City will cost more than one in Springfield, Massachusetts.

Size

Size is perhaps the greatest factor that impacts the price of your box. Naturally, smaller boxes will cost less than larger ones.

Security features

The type of security features used can affect the safety deposit box cost. For example, advanced security measures like biometric access and video surveillance will come with higher fees.

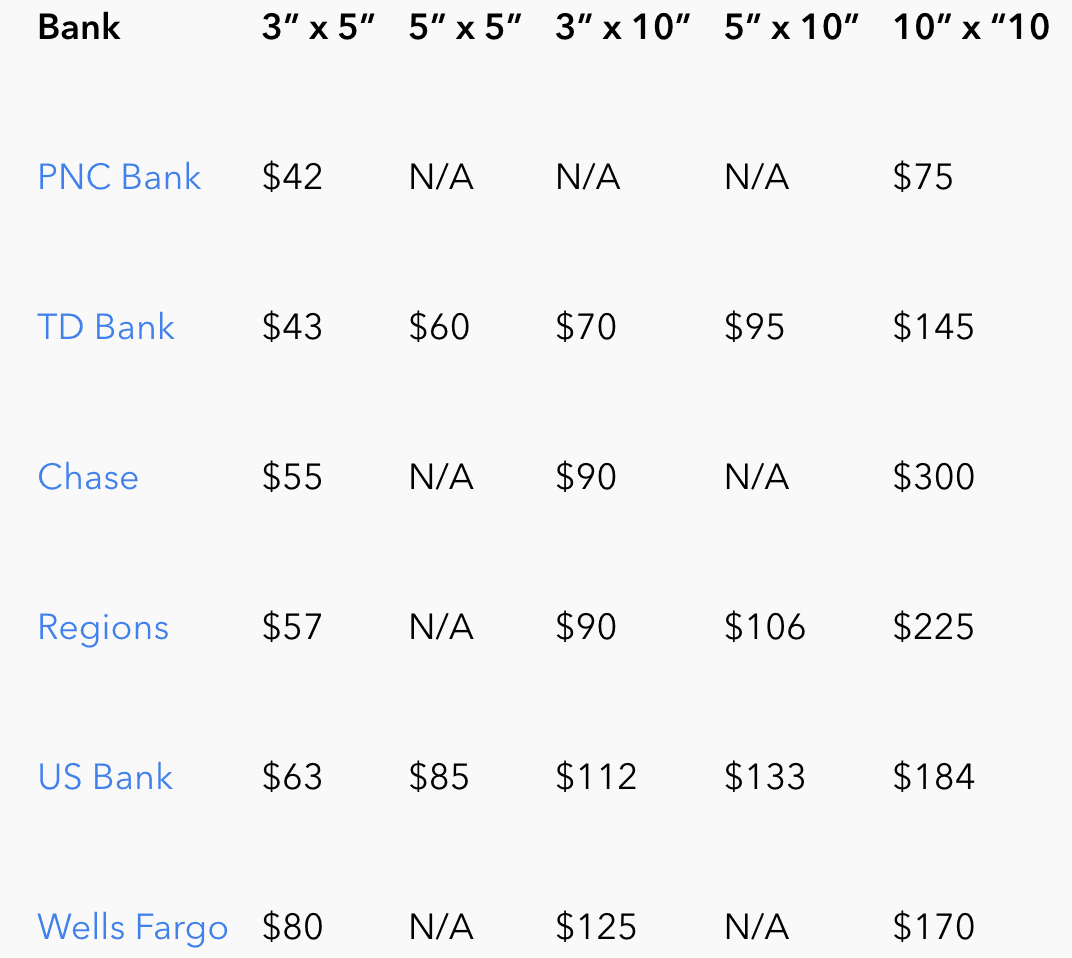

For some reason, banks can be hesitant to reveal the price of their deposit box leasing fees. To make life easier, I’ve included a pricing table below to give you some insights into the annual costs.

Safety Deposit Box Alternatives

The declining availability of safety deposit boxes at banks has resulted in people looking for alternatives to bank safe deposit boxes, like home safes and private vault services.

These options are often more affordable with a once-off investment purchase and easily accessible, especially if you are in your home. Home safes can be insured through homeowner insurance or private safety deposit box insurance.

While home and private vault services are excellent alternatives, there is one option that stands out from the rest. Trustworthy’s digital vault. Trustworthy’s Family Operating System® is designed to get and keep families organized.

The smart AI-powered Autopilot feature has tools like predefined categories, filename suggestions, and document insights for hassle-free document organization and storage.

Trustworthy keeps your important information safe with bank-level security features like AES 256-bit encryption, multi-factor authentication, biometric authentication, physical security keys, tokenization, and advanced threat detection.

Set up a trusted network of family and professional collaborators to share documents instantly and control their access. Use SecureLinks™ to share securely outside your network with expiring, access-only links.

Safety Deposit Box vs. Trustworthy: Which Is Cheaper?

Safety deposit boxes can be a cost-effective way to store your valuable belongings, but is it the most affordable option? Trustworthy offers world-class protection for your digital assets, and multiple family members can easily manage them.

Safety deposit box: The average cost for the smallest available safety deposit box at a major bank in the US is about $57 per year. With that, you get a 3” x 5” container and round-the-clock protection for your valuables. However, that’s not enough storage space if you’re looking to safeguard numerous important documents. In that case, you’d have to go with a 10” x 10” that will cost you about $183 annually.

Trustworthy. Trustworthy offers free and premium levels, depending on your family's needs.

While the average price for a safety deposit box might cost less, there are some limitations you need to consider.

For starters, you need to be physically present to access the contents inside. With Trustworthy, all your assets are stored digitally and can be accessed anywhere by all authorized family members.

Moreover, you don’t need to keep track of a tangible key. Trustworthy only requires you to create a password you can use to get full access to your records.

In conclusion, you get more value for your money if you use a digital safety deposit box like Trustworthy. Check out Trustworthy for free.

How Much Does It Cost if You Lose Your Safety Deposit Box Key?

One pitfall of owning a safety deposit box is keeping track of your key. While losing your safety deposit box key isn’t the end of the world, it can be a daunting and expensive process to access your valuables. The average cost for locksmith fees to drill into your safety deposit box is about $150.

You also need to notify your bank ahead of time, which can delay access to your items. What’s more, you can only drill into the lock during normal banking hours.

In our other article, we cover the exact steps on what to do if you lose your safety deposit box key.

Does It Cost Money to Give Someone Access to Your Safety Deposit Box?

Due to the value of contents typically kept inside safety deposit boxes, banks usually have a strict protocol about who can access them.

You need to assign someone as a co-renter to grant them access. Most major banks don’t require an additional fee to assign a co-renter, but you might need to pay a small cost for an extra key.

Note that giving someone access grants them the same permission you have to access your box. Make sure that you only assign someone you completely trust. Most people assign their spouse or family member in case of emergencies.

Compared to safety deposit boxes, Trustworthy allows much more flexibility for who can access your records, how long they have access for, and which documents they can see. For example, you can invite your spouse as a collaborator to access all your information, while inviting your accountant to review your finances only during tax season.

How Much Does Insurance Cost for Safety Deposit Boxes?

Most banks don’t insure their safety deposit boxes, so you’ll need to do so via a third-party provider.

Some insurance companies will cover the items in your security deposit box for as low as $25 a month. You can also add-on out of the box coverage to protect your goods when in your possession.

However, you’ll need to keep in mind that not all items can be insured. To learn which items you can cover, you’d need to speak directly with the insurance provider.

Final Thoughts: Is a Safety Deposit Box Worth It?

Safety deposit boxes can be a worthwhile investment if you own items too valuable to lose. They are especially common for storing jewelry, estate planning documents, and a last will and testament. However, a safety deposit box also comes with limitations.

If you’re looking to store sensitive files, you’re better off going with a digital safety deposit box. Trustworthy offers cutting-edge encryption for all your digital goods. Try Trustworthy free today.

Trustworthy offers cutting-edge encryption for all your digital goods and even has an Estate Planning section where you can update your last will and testament anytime and anywhere.

Frequently Asked Questions

Which Bank Has the Cheapest Safety Deposit Box?

The cheapest safety deposit box at a major bank would be the 3" x "5 box at PNC.

Can You Get Discounts on Your Safety Deposit Box?

Some banks offer discounts on their annual safety deposit box fees depending on what kind of account holder you are. You'd need to check with your bank to see if you're eligible for discounts.

Related Articles

We’d love to hear from you! Feel free to email us with any questions, comments, or suggestions for future article topics.

Trustworthy is an online service providing legal forms and information. We are not a law firm and do not provide legal advice.