If you need to send your credit card info to another individual, email may seem like a suitable delivery option. It’s quick, convenient, and easily accessible for the recipient. But is it safe to send credit card info by email?

Email accounts are frequently breached because it’s challenging to keep track of all the devices an email is logged in on. In this guide, you’ll learn how to send your credit card info securely and how Trustworthy can help you.

Key Takeaways

Sending your credit card info via is not safe and puts your info at risk of a data breach.

To send your credit card info securely through email, you should encrypt your file.

Send and store your credit card info in a secure location with Trustworthy.

Risks of Sending Credit Card Info by Email

Ideally, you should never send your credit card info by email. Of all the ways you can transfer information to another person on the internet, email is the most likely to be compromised. The recipient can forward your credit card info to another person, or somebody can access their email account.

Alvaro Puig, a consumer education specialist from the FTC, advises: “If you get a message about an unexpected package delivery that tells you to click on a link for some reason, don’t click.”

So, knowing how to protect your personal data is so important.

There are several risks to be aware of when you send your credit card info by email. These include account hacks, data breaches, and unsafe handling by the recipient.

Risk 1: Compromised Email Accounts

When you email your credit card info to another party, your credit card will live in your email account and their email account. Therefore, anybody who accesses either account can view your credit card info. You should also keep track of where your email is logged in.

Your risk is amplified because you’ll also need to worry about the recipient’s email account. Is the person you’re sending your credit card info to somebody who practices safe email usage? Can you trust them not to forward your credit card info to somebody else?

Risk 2: Data Breaches

Any messages you send by email are plainly viewable by any mail server that transfers the message along the way. Depending on how and where you send the email, there may be three or four mail servers that help to deliver your email.

However, some mail servers, such as Yahoo and Gmail, automatically encrypt transmissions between you and their servers. But once your email goes into another mail server without encryption, your credit card info is exposed. Hackers can scan your sent messages for emails containing sensitive information like your credit card number.

How to Send Information Securely by Email

If you want to send your credit card by email, you must follow a few crucial steps to protect your information.

Although I don’t recommend sending your credit card or any other sensitive information by email, here’s the best way to secure your email.

1. Put Your Credit Card in a Separate Document

First, it’s crucial to put your credit card information in a separate text document. You should never paste your credit card in plain text in an email body. Instead, I recommend using a separate document program like Microsoft Word.

Furthermore, don’t input your entire credit card information into the document. It’s always risky to send your entire credit card, including all 16 digits, the expiration, and CVV. Instead, I recommend leaving out the CVV and sending it to the recipient using another communication platform.

2. Encrypt Your File

Once you input your partial credit card info into the Word document, secure the file with a password. On Microsoft Word, click File, then Protect Document. You can find the Protect Document option under the Info section.

Next, click Encrypt with Password. Type in a unique and complex password. After you encrypt your file with a password, the document will ask you to enter the password when you open the document in the future.

Therefore, hackers can’t access your credit card info even if they breach your email account and find the document.

3. Send Email From a Secure Wi-Fi Network

Never send sensitive emails from a public Wi-Fi network. Cybercriminals can monitor unsecured networks and steal your personal information. Instead, send the email from your home Wi-Fi network but make sure your network is password-protected first.

Then, attach the document to the email and enter the recipient’s email address. Before you press Send, make sure the recipient’s email is correct. This way, you can guarantee the email is going to the right person.

4. Share File Password and CVV Separately

After you send the email, you’ll need to share the document’s password and your CVV. The best way to accomplish this is by calling the recipient. Ask the recipient to call you once they’re ready to open to document. By sharing your file password and CVV by phone, your info won’t be permanently stored anywhere in text form.

5. Delete Email After Sending

Delete the email from your Sent folder as soon as the recipient receives it. Then, delete the email from your Trash folder. Since you don’t need to store your own credit card info, there’s no reason to keep it inside your email account. The longer your credit card info lives on your email account, the higher the risk of someone stealing your info.

Furthermore, ask the recipient to delete the email once they finish using your credit card. The most significant risk when sending your credit card info by email is how the other person handles your information.

It’s imperative the recipient deletes the email from their inbox and Trash folder. Once they delete your email, you can alleviate most of the risks that are out of your control.

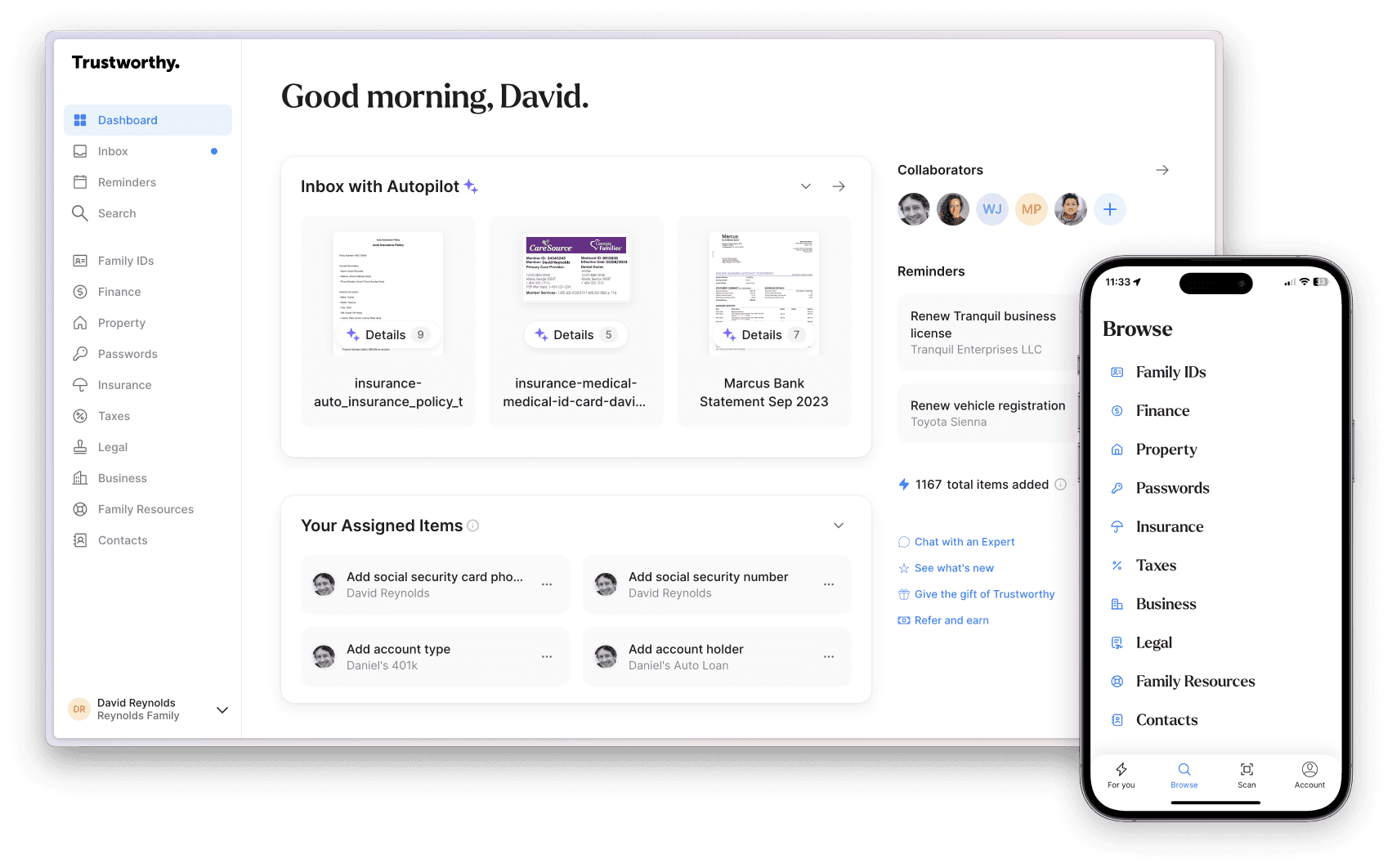

Luckily, Trustworthy has a much easier and more secure solution for you. With Trustworthy, you can safely share a secure link that provides a view of your credit card. You can control who has access to the link and for how long (i.e 1 hour, 1 day, 1 week). You can also see how many times the link has been viewed and revoke access at any time.

Other Ways to Share Your Credit Card Information Securely

There are a few alternatives when you need to share your credit card information quickly and securely. While Trustworthy is the best platform for sharing sensitive information, it’s important to discuss all of the available options.

Let’s dive in.

How Trustworthy Can Help Share Your Credit Card Information (Better Than Email)

Don’t risk financial damage by emailing your credit card info. Trustworthy is a highly secure digital storage platform with innovative sharing capabilities. It’s immensely more secure to send your credit card info using Trustworthy than email. This is because Trustworthy offers bank-level encryption and requires all accounts to enable two-factor authentication. To share with trusted family members or contacts that may require ongoing access to your credit card information, you can give individuals permissions that allow them to view your information.

You can send the collaborator limited access to information in your Money section by sending an email invitation. Once you send the invitation, the collaborator will receive an email and is required to create a Trustworthy account with two-factor authentication to view your shared credit card info. You can share much more than just your credit card info. You can use Trustworthy as a family management platform to store all of your sensitive information. Then, your family members can access the information they need at any time.

Trustworthy (Try it free) eliminates the risks of sending your credit card by email and protects your private information.

2. Secure Messaging App

Several third-party messaging apps offer end-to-end encryption. This secure communication process prevents third parties from accessing your data and creates a secure data tunnel for you and the recipient. As such, outside parties can’t view your messages and credit card info.

The best third-party messaging apps are:

WhatsApp

Signal

Telegram

These apps are free to download on your mobile device and computer. Furthermore, you can add password protection through these apps with a text password, fingerprint, or face ID. Enable password protection in the Settings menu of each app.

3. Phone Call

Instead of sending your credit card info by email and leaving a paper trail, it’s safer to call the recipient. Then, the recipient can enter your credit card info directly into a payment processor without needing to jot it down.

Split Your Credit Card Info Through Two Channels

Hackers need your credit card number and the CVV number to use your credit card. Splitting this information and sending it via different channels can make it harder for information to be breached. For example, you could email the credit card number and call the recipient with the CVV code.

Frequently Asked Questions

What is the most secure way to share your credit card info?

The most secure method to send your credit card info is through a secure file-sharing platform like Trustworthy.com.

Is it safe to send a picture of your credit card online?

Sending a picture of your credit card instead of typing the numbers out is not any more secure.

Is it safe to send credit card info over fax?

While it’s not the most secure method, you can fax your credit card information if it has TLS encryption.

Other Credit Card Resources

We’d love to hear from you! Feel free to email us with any questions, comments, or suggestions for future article topics.

Trustworthy is an online service providing legal forms and information. We are not a law firm and do not provide legal advice.