When tax time rolls around, do you scramble to find everything you need? Important documents make a clear difference in your financial bottom line, so you must ensure they’re organized and ready to go.

Storing tax documents in an encrypted, organized system makes sense. Trustworthy can help you stay on top of your expenses, income, deductions, and more. Read on to learn how you can manage your tax documents and other important information without frustration or worry.

Key Takeaways

The importance of safe storage of tax documents can’t be understated.

The list of documents you need to keep throughout the year is quite long and comprehensive.

Following best practices when storing tax documents can make tax time much easier.

How to Store Tax Documents

The easiest way to store tax documents is through Trustworthy. The process is simple:

Scan the documents. You can use a simple scanner. If you don’t have one, your local library does. You can also take photographs of the documents with your phone and upload them from there. (Just remember to delete them from your phone after you upload them, as they aren’t safe on your device!)

Upload to the cloud. When you upload your documents to Trustworthy, they go into a secure cloud you can easily access but others can’t. This keeps your documents safe and secure, allowing you to retrieve them at will and move them around for proper organization.

Organize the documents. Trustworthy provides tips and tricks for best organization practices, which allow you to move your documents into an order that makes sense for you. Trustworthy will even suggest file names! Proper organization means you can get to your documents the moment you need them without clicking through dozens of folders and trying to remember what name you assigned to a particular document.

Email the documents to yourself. Want even more peace of mind? A dedicated email address at Trustworthy means you can email documents to yourself for even better organization and security. This can be especially helpful when you are in a time crunch but need to get a particular document into the Trustworthy system right away.

Best Practices When Organizing Tax Documents

Staying organized can make a world of difference at tax time. In addition to using the valuable tools at Trustworthy, keep these best practices in mind:

Start early. Don’t wait until the week before the tax filing due date! Collect documents as early as you can. Remember that in most cases, employers and other entities must send out their tax forms no later than January 31, so you should have everything within a few weeks after that date.

Upload the documents digitally. Keep the paper documents, as your tax preparer will likely want the physical copies. But also scan and upload them to the cloud as soon as possible so you know they’re safe and secure.

Use a naming convention that works for you. Trustworthy will suggest file names that might work well for you, but never hesitate to make it your own. Create file names that make sense to you and your personal organization style.

Keep personal and business separate. Don’t keep your tax documents in the same folders where you keep personal information. Keeping them separate helps avoid confusion as the number of files grows.

Review your tax documents each year. After the filing season is over and your return is sent off to the IRS, review the tax documents from previous years. Is there anything outdated? How about redundant or irrelevant? You can remove them or move them to a separate space in Trustworthy, so you have them just in case.

Strong organization for all of your documents is a must. This allows you to quickly respond to any requests for documents, provide additional information if requested, and collaborate well with your accountant or tax professional. It can even help you save money by maximizing your deductions.

For example, if you make a habit of uploading your receipts for expenses, you have them all right at your fingertips during tax time. There’s no more searching through piles of paperwork to find them. It’s all right there in a beautiful, seamless organization, so you don’t run the risk of missing anything.

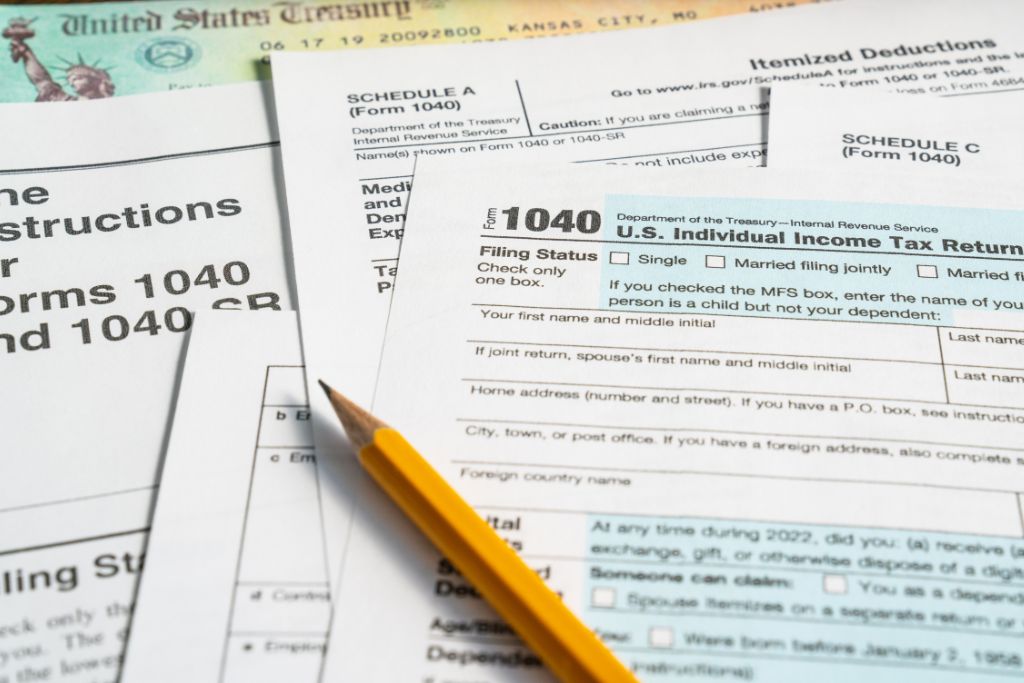

Tax Documents to Keep

These are the documents and information you need to keep:

Personal and Dependent Information

Here’s a reminder of important information you’ll need:

Social security and tax identification numbers for everyone who will be on your tax return, including all dependents

Full names and dates of birth

An Identity Protection Pin, if you have one

Routing and account numbers for the bank account you intend to use for your refund or to pay your tax balance

Foreign residency information, if applicable

Childcare records, if applicable

If child custody is shared, you will also need Form 8332, which allows one parent to claim a child on their taxes

Income Information

You’ll need some of these forms year after year, while others appear on your taxes only when there is some sort of income change. For instance, you would only receive forms concerning the sale and capital gains of a home if you sold a home during that tax year.

Income information for all dependents and everyone in the household

Forms that reflect your income or work status, including W-2s, unemployment forms, forms 1099 for self-employed individuals (and income records to verify all amounts not reported on the 1099s)

Records of all expenses throughout the year related to your job

Home office information, if applicable

Records of estimated tax payments made throughout the year (Form 1040-ES)

Rental income, including records of expenses and asset information for depreciation

Retirement income, including pensions, IRAs, social security income, annuities, or disability.

Interest or income from dividends, sales of stock, and income from any property sold.

Health Savings Account reimbursements

Any transactions involving cryptocurrency

Other income, including prizes and awards, gambling income or lottery winnings, jury duty reimbursement, hobby income, royalties, a record of alimony (paid or received), and a record of your state tax refund

Deductions

These are the documents that can lower the amount of tax you owe. Some people will have certain documents to use every year, while others will never have all of these.

Real estate information, mortgage interest statements, and tax records for any property you own

Receipts for energy-saving home improvements

Information on your vehicle

Charitable donations to schools, houses of worship, or non-profit organizations

Record of miles driven for medical or charitable purposes

Medical expenses paid to doctors, dentists, hospitals, and other healthcare providers

Amounts paid for insurance premiums

Form 1095-A if you are enrolled in health insurance through the Marketplace

Expenses for childcare, including payments to a licensed daycare center or a babysitter for a child under the age of 13 during work hours

Educational expenses, often listed on form 1098-T

Receipts for qualified educational expenses and records of scholarships or other financial assistance

Form 1098-E, if you paid student loan interest

Receipts for classroom expenses (if you are an educator in grades K-12)

Record of any state and local taxes paid, including sales tax

Information on property taxes (keep in mind that property taxes are different from county taxes)

Vehicle sales tax or personal property tax on vehicles

Retirement contributions to an HSA, IRA, or any 5498 series forms

Finally, if you lived in an area affected by a federally declared disaster and had expenses resulting from it, keep records on the property losses, such as clean-up costs and appraisals, rebuilding costs, insurance reimbursements, and any FEMA assistance information.

How Long Should You Keep Tax Documents?

According to the Internal Revenue Service, it depends on the reason that you have that particular document. In most cases, you will keep records for three years from the date you filed the original return or two years from the date you paid the tax bill, whichever is later. But there are some caveats.

Patrick Bay, a CPA, explains:

“There are two deductions that you want to keep records of for seven years. One being the worthless securities deduction meaning that you owned a stock that has gone to zero… second, if you have a bad debt expense, meaning you’ve invoiced somebody for services, products, whatever, and they didn’t pay you… you can write off that, and that documentation needs to be kept for seven years.”

Other caveats include:

Keep records for 6 years if you don’t report all income (and it is more than 25% of the gross income on your return)

Keep records of employment tax for at least 4 years after the date the tax is due or paid, whichever comes later

Keep records indefinitely if you don’t file a return or if you have ever fraudulently filed a return

It’s a good idea to keep records relating to property on hand indefinitely, as you might need them to calculate depreciation, gains, losses, or capital gains in the future.

It’s also a good idea to check with other agencies to ensure it’s okay to get rid of certain tax records. For example, an insurance company might want you to keep records for longer than the IRS requires.

Frequently Asked Questions (FAQs)

What is the best way to store old tax documents?

The Family Operating System by Trustworthy can help you keep your old documents safe and secure until you no longer need them. These documents are stored with top-notch security that prevents hacking and other nefarious activities that could compromise your identity and other information.

How do I organize my tax return documents?

Organizing your tax documents can be an enormous help, as you know where everything is, and it’s right at your fingertips if you ever need it. The organization tools from Trustworthy arrange your information automatically so you don’t have to spend too much time moving things around.

Document locations, names of files, and summaries of what is in each section can help you organize even further.

Should I keep my 20-year-old tax returns?

Break out the shredder and get rid of those old returns. In most cases, you need to keep those tax returns for three years from the date you filed or seven years if you have worthless securities or bad debt to deduct.

Remember, though you should get rid of the tax returns, you might want to keep the documents themselves for a longer period. For instance, keep all records pertaining to the purchase of a rental property, as you might need original documents to help you claim depreciation over time.

Can the IRS audit you after 7 years?

In general, the IRS audits only those returns filed in the last three years. However, if there is a substantial error in reporting, the audit might cover the last six years. The IRS makes every effort to conduct audits as soon as possible after the tax return is filed.

We’d love to hear from you! Feel free to email us with any questions, comments, or suggestions for future article topics.

Trustworthy is an online service providing legal forms and information. We are not a law firm and do not provide legal advice.