People worldwide rely on safety deposit boxes to keep their most precious valuables secured. While most resort to their local bank to store their items in a safety deposit box locked inside a vault, this isn’t always the best choice due to limited access and tight regulations.

There are various other types of safety deposit boxes that might be more convenient for your valuables. Some are optimized for storing jewelry, being fireproof, and other safety deposit boxes are completely digital.

In this post, you’ll learn the 7 different types of safety deposit boxes and what they’re primarily used for.

What Is a Safety Deposit Box?

A safety deposit box is a sealed container (typically made from metal) that is stored inside a safe or a bank vault. People use safety deposit boxes to store valuables, such as hard cash, jewelry, important documents, or anything else they want to secure for extended periods of time.

One of the most common uses of a safety deposit box is to store a copy of your last will and testament or other types of trust documents.

These boxes are also usually built to withstand natural disasters, like fires, hurricanes, and tornados. Most people lease safety deposit boxes from banks so they can depend on the building's security to ensure their items are well-protected.

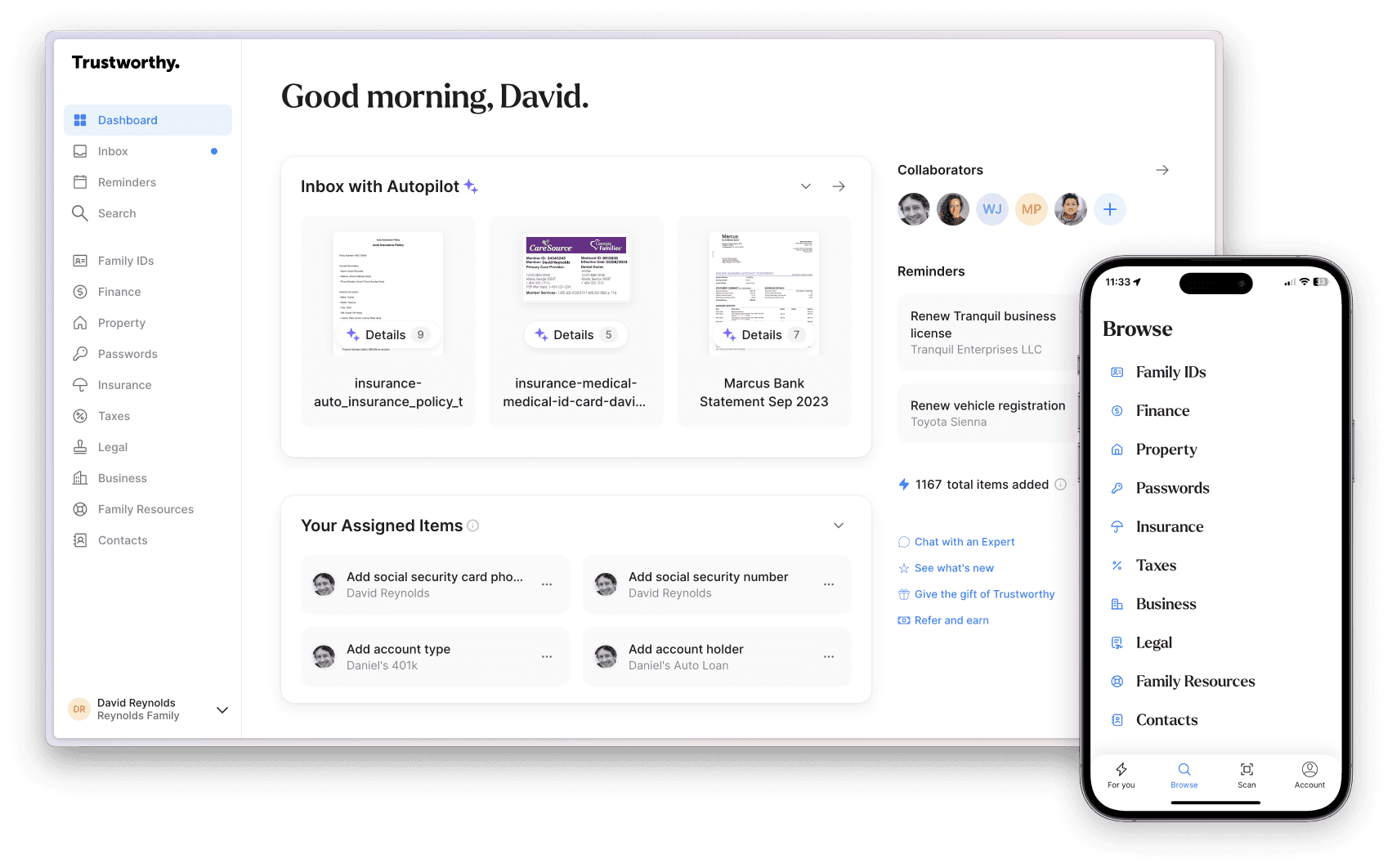

Trustworthy is the leading Family Operating System designed to protect, optimize, and organize all of your important information. Ensure your family is prepared for all life moments and emergencies with Trustworthy. Try Trustworthy free.

7 Types of Safety Deposit Boxes

1) Safety Deposit Box in Vault

Leasing a safety deposit box from a bank is one of the more popular options, as you get added security from storing your items in their vault. When you rent a safety deposit box from a bank, they’ll give you a key to use simultaneously with their guard key to access your valuables.

Some banks use a keyless system that requires biometric authentication, typically using a fingerprint scanner. No matter the case, you’ll also be required to produce some form of identification along with your key to open the safety deposit box.

You can either lease a box as an individual or have a co-lessor. However, your co-lesser has equal rights to access your valuables, so be mindful about who you choose. Bank safety deposit boxes are an excellent place to store sensitive documents, hard drives with important information, or small collectables.

Pros

Your safety deposit box is under tight security 24/7

Contents are legally protected even if the owner dies

Your box is both fireproof and waterproof

You can assign a co-lessor if you lose your key or aren’t physical present to access your goods

Cons

Access is limited to banking hours

There’s a chance you could lose your key

You have to pay an annual fee

With Trustworthy, all of your important documents and assets are beautifully organized and securely protected. Most importantly, you, your loved ones, and your trusted advisors can access the information they need anytime and anywhere.

2) Portable Safety Deposit Box

A portable safety deposit box (also known as a portable safe) is a secure container designed to keep your valuables safe wherever you go. You can take one with you while on vacation, going on a business trip, or keep one in your home. Portable safes come in several shapes and sizes depending on your needs.

There are models that weigh less than 5 pounds if you only plan on storing small items, such as your wallet, phone, keys, etc. Moreover, you can find robust portable safes that are suitable for storing computers, electronic devices, or folders containing sensitive documents.

These secure containers usually have a digital lock using a keypad to access your contents. Some older models might use a wheel-lock combination. Portable safes are designed to fit easily in your suitcase to protect your valuables while traveling. You can also implant a GPS tracker in case it’s stolen or lost in transit.

Pros

Compact design that’s easy to carry

Various shapes and sizes to choose from

Instant access to your valuables

Cons

Limited space for storing several items

Not as secure from theft

3) Digital Safety Deposit Box

With so many important documents being digital, your sensitive information is at high-risk of being stolen by hackers with bad intentions. From stolen money to identity theft, there are various ways you could be at risk if you don’t safeguard your data.

That’s where digital safety deposit boxes come in handy. Data safe providers keep your information in digital safes that are encrypted to fend off against those with unauthorized access. You’re allowed to create a password to access your digital safety deposit box, and your provider can even help you create a strong password for maximum protection.

Trustworthy uses cutting-edge data encryption to protect your sensitive files from hackers and other security breaches. We require all our users to verify their identity upon creating an account, and use two-way authentication for maximum protection. You can use Trustworthy to store your ID cards, family passwords, financial documents, estate planning, and more.

Try Trustworthy free and get peace of mind that your sensitive information is being stored safely and securely.

Pros

State-of-the-art encryption technology for maximum protection

Worldwide access to digital assets

24/7 account support

Multiple family member access

Cons

Annual fee

Only useful for digital assets

4) Wall Mounted Safety Deposit Box

Wall safes are an excellent option if you want to store several belongings in your home or office. Some are even large enough to hold massive art pieces. As the name suggests, these safes are mounted to the wall and aren’t portable.

However, they are quite discreet as they’re mounted inside the walls of your home. Criminals will have a hard time locating them, let alone getting inside.

Many people place a painting or piece of tapestry in front of their wall safe to ensure it’s not in view. Meanwhile, thieves can’t remove the safe as it’s securely installed to the building’s foundation. Unlike portable safes, criminals can’t steal the safe itself and open it in the comfort of their hideout.

Furthermore, wall mounted safety deposit boxes are resilient and resistant to fire and water. If your home is affected by a natural disaster, you can rest assured your valuables will be safe and sound.

Pros

Installed directly into your wall and hidden from sight

Can’t be removed or stolen

Large design for storing numerous items

Cons

Not portable and difficult to relocate

Can be pricey to install

5) Fireproof Safety Deposit Box

According to the National Fire Protection Association, the United States sees about 346,800 house fires every year. These fires equate to roughly $7.3 billion in property damage. Fires usually come unexpectedly, but having a means to protect your valuables is a wise decision in the unlikely event of a house fire.

As a result, a fireproof safety deposit box can be a worthwhile investment. Fireproof safes use special insulation made from either Perlite, Insulite, or Vermiculite that protect your valuables when exposed to extreme heat.

These fire-rated containers can keep your contents safe for several hours in high temperatures of up to 1000 degrees Celsius. Luckily, the average response time for a house fire in the US is about 20 minutes.

Not only do fireproof safety deposit boxes protect your valuables from fires, but they also act as normal safes with secure locks. Most come with a keypad system, but you might also find some safes using a wheel-dial lock. They’re an excellent way to safeguard your goods from thieves and nature.

Pros

Resilient materials to protect your belongings

Various sizes to choose from

Can lower insurance premiums

Cons

Safe can be removed by thieves

Can be quite pricey

6) Jewelry Safety Deposit Box

If you want to have instant access to your precious jewelry, then investing in a jewelry safety deposit box is the way to go. You can use a residential security safe to store all your expensive jewels directly in your home. The only drawback is that many of these safes aren’t resilient to natural disasters, such as floods, tornados, and hurricanes.

However, jewelry safety deposit boxes make it incredibly difficult for thieves to steal your goods. All your jewels are right at your fingertips, and secure behind a durable metal shield combined with a digital lock.

Storing your jewelry inside a residential safe is more convenient than using a bank vault. All you need is your passcode or key, and don’t need to wait for banking hours to access the contents inside.

Pros

Immediate access to all your jewelry

Seamless yet secure locking mechanism

Relatively low cost

Cons

Not as secure as a bank vault

Might be vulnerable to natural disasters

7) Private Vault Style Safety Deposit Box

If you’re not prone to storing your valuables at home but don’t have access to a bank vault, then a private vault style safety deposit box is likely the best alternative.

Several companies offer private vaults that vary in shape and size to suit your belongings. What’s more, these vaults often come with the latest security technology to maximize the protection of your items.

For example, some come with sensors that detect fires and immediately activate a fire safety system. Others use backup generators to keep the containers locked in the event of a power outage. Moreover, private vaults offer 24/7 access, eliminating the limitations that come with storing valuables in a bank.

The only downside is that these private vault style safety deposit boxes can be quite expensive. However, the fee you pay will immensely outweigh the cost of losing your prized possessions.

Pros

24/7 access to your belongings

Advanced security measures for maximum protection

Various shapes and sizes to choose from

Cons

Huge reliance on a private organization

Not as cost-effective as other options

Which Type of Safety Deposit Box Is Best?

The best type of safety deposit box truly depends on your needs. If you’re looking for an ultra-secure place to store your belongings, going with a bank vault safety deposit box is likely the best option. For storing digital assets, then you’re better off with a digital safety deposit box.

You can also spread your inventory across multiple safes to reduce risk. For example, storing your estate planning in a digital safety deposit box and holding your precious metals and jewels in a bank vault.

If you’re looking for a secure place to store your sensitive files, passwords, and valuable digital documents, Trustworthy can help. With Trustworthy, you can manage all your digital assets on one secure platform.

Other Safety Deposit Box Resources

We’d love to hear from you! Feel free to email us with any questions, comments, or suggestions for future article topics.

Trustworthy is an online service providing legal forms and information. We are not a law firm and do not provide legal advice.