A consultation with an estate planning attorney is often a stressful experience.

You know you are going to a meeting where someone will ask about your final wishes and many more uncomfortable questions. Knowing what to bring to an estate planning meeting can make you feel more comfortable when you go into an attorney's office for the first time.

The things you should bring to an estate planning meeting include the following:

Beneficiaries list.

Name of executor(s).

Your financial records.

Prenuptial agreements, divorce agreements, and other important contracts.

A list of questions for the attorney.

Your lawyer will use this information to create an estate plan that meets your needs and goals. This list should only be used as a general guide; your attorney may need further details.

1. Beneficiaries List

Make a list of the beneficiaries you wish to designate in your estate plan, together with the assets you want them to inherit.

Who, for instance, do you want to inherit your house and your cars? Who should inherit your precious collection of stamps? Try to include each person's most up-to-date contact information in your estate plan documents.

At Trustworthy, we encourage our clients to make a beneficiaries list as soon as possible. Even though you might feel you have plenty of time to list your beneficiaries, nobody can predict the future.

If you don't designate beneficiaries, your assets will go through the probate process, and the state will decide where they go.

2. Name of Executor(s)

A list of the people you want to appoint as your estate's executors should also be brought with you.

For instance, who would you want to name as your power of attorney if you were to become incompetent and require someone else to make decisions regarding your estate?

Establishing a medical power of attorney is also a good idea if you lose consciousness or cannot express your healthcare preferences.

Bring a list of any close family members and acquaintances you would trust to handle your estate in your absence, together with their most recent contact information.

To assist you in choosing the best candidates for those positions, your estate planning lawyer may walk you through all your alternatives.

3. Your Financial Records

Even though your attorney doesn't need to have all of your asset papers at your initial consultation, giving them the following right away will make the process go much more quickly.

Deeds to Real Estate

Your attorney has to know who holds the title to your real estate to put it into your trust.

Make sure to attach a copy of the deed as recorded with your county recorder's office, as each new deed must have the legal description that appears on the preceding one.

Financial Statements

The first page of your most recent bank and investment account statements, including those for your checking, savings, money market, brokerage, pension, and retirement savings, must be brought with you.

These statements must list the names of the account owners, the account numbers, and the balances for each account.

The ability to move accounts into a trust is impacted by the fact that many people have additional family members identified as co-owners on one or two of their accounts.

Co-owned accounts should be reviewed with your attorney immediately to ensure that your estate plan appropriately addresses them.

Business Agreements

If you operate a business or have a stake in a partnership, your lawyer will require a copy of your business contracts, such as leases and buy-sell agreements.

Without first knowing whether a business agreement has clauses governing the distribution of your stake upon death, especially if you have partners, your estate plan cannot be completed.

Certificates of Trademark, Patent, and Copyright Registration

Your trust should get an assignment of your intellectual property, either directly through the U.S. Patent and Trademark Office or through a different assignment.

Stock Certificates

Your attorney will require copies of your stock certificates to transfer your shares to your trust.

Life Insurance Information

What financial resources would your beneficiaries have after your passing?

Even a modest life insurance policy's payment can make a big difference.

Make sure to provide copies of your insurance binders so that their value will be considered during the estate planning process.

A standard insurance binder is a one-page document that includes information about the policy's owner, policy number, and death benefit.

4. Prenuptial Agreements, Divorce Agreements, and Other Important Contracts

Your estate plan should follow any prenuptial or divorce agreements.

Additionally, it should adhere to the conditions of any prior agreement you might have made pledging to leave property to someone in your will.

5. A List of Your Questions

Bring all your questions to your initial estate planning consultation so your estate planning lawyer may address them.

Nobody expects you to display any degree of competence in estate planning, so feel free to ask questions about anything you don't understand. You have knowledge and experience in your field of business, and your attorney has knowledge and experience in theirs.

Do you need clarification on the distinctions between a trust and a will? Are you unsure if a revocable or irrevocable living trust is necessary? The impact of a recent divorce or your impending retirement on your estate plan may also be something you need clarification on.

You may want to ask about the following:

Estate planning documents' format, function, and operation.

The effects of your estate planning decisions on taxes.

The procedure your lawyer will follow (scheduling, initial appointments, meetings to review documents, signing sessions, and any necessary telephone conferences).

Background and experience of your lawyer.

How to determine your estate planning fees.

Additionally, confirm that your lawyer will sit with you to review drafts. This allows you to confirm that your lawyer drafted the documents per your wishes. You can also ask your lawyer to clarify any provision of any document they ask you to sign.

Whatever the question, write it down and bring it with you.

Other Considerations

Your estate planning lawyer needs to know if any of your beneficiaries have special needs, are receiving (or are likely to receive) means-tested government assistance, appear likely to get divorced in the near future, struggle with any addictions, are currently in jail or have ever been in jail, or have debt-related problems.

How Trustworthy Can Help

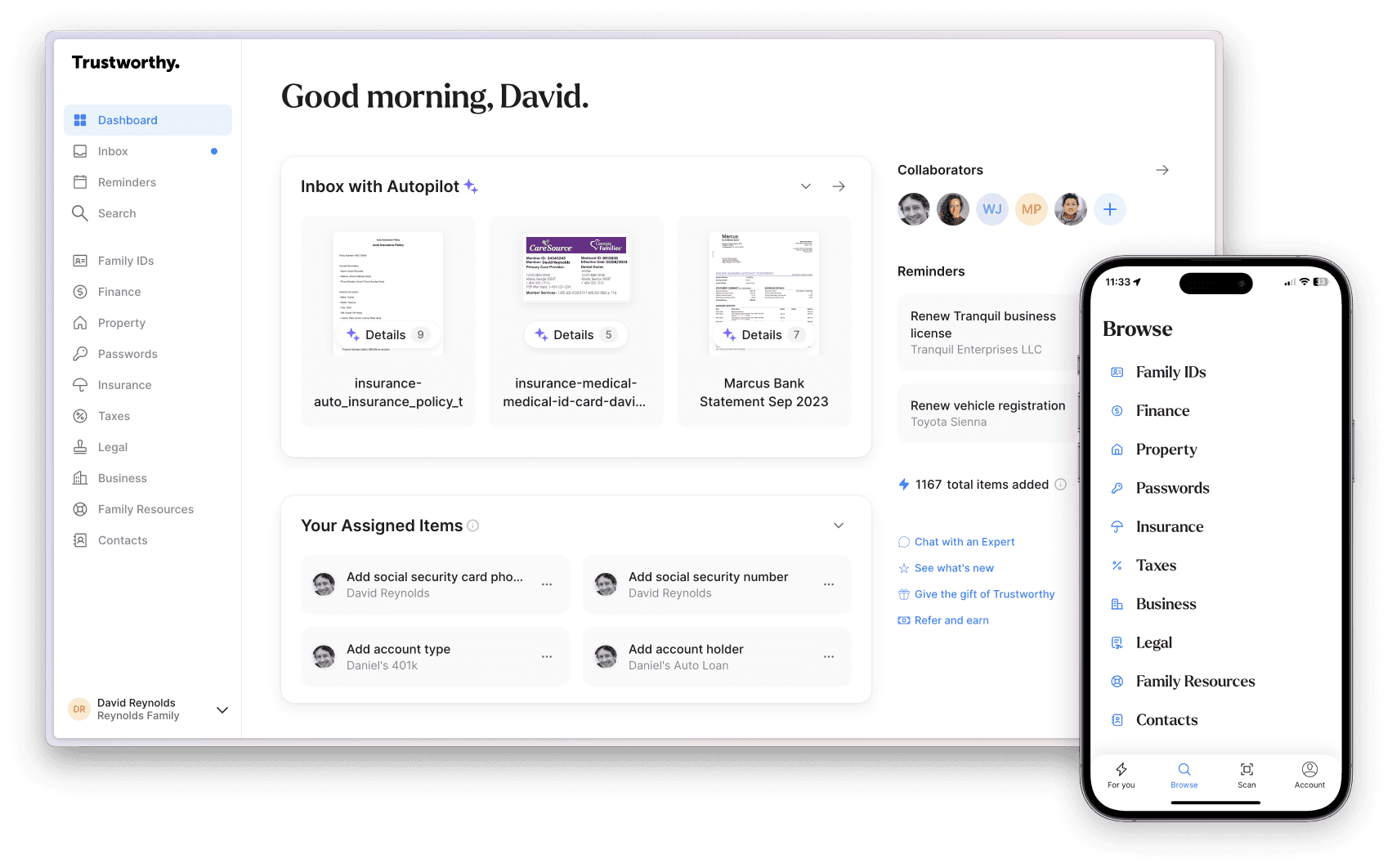

Trustworthy’s Family Operating System® allows you to keep all of your estate planning documents secure and organized.

Trustworthy works to keep your estate planning documents safe at all times. You can readily access your estate planning documents with Trustworthy whenever and wherever you need them. You can also invite close relatives or reputable experts to amend your estate documents.

Trustworthy is a space that works for all. From bank-level security to customizable collaborations, Trustworthy does things that no other organization system can do.

Ditch your files and folders by trying Trustworthy for free.

Other Estate Planning Resources

We’d love to hear from you! Feel free to email us with any questions, comments, or suggestions for future article topics.