Filing your taxes with even a small mistake can delay your refund by weeks — or sometimes months. In fact, nearly half a million returns were flagged for corrections and routed through the IRS’ FixERS tool in 2024, a system designed to catch and fix filing errors before returns are processed.

A structured approach to gathering documents, filing forms, and tracking deadlines can reduce your margin for error. In this guide, we’ll explore how to be better organized by using a digital vault like Trustworthy's Family Operating System® to keep you on track this tax season.

Key Takeaways

Being organized for tax season helps prevent errors that can delay your refund.

Common errors caused by disorganization are missing documents, inaccurate numbers, missing information, and incorrect deductions.

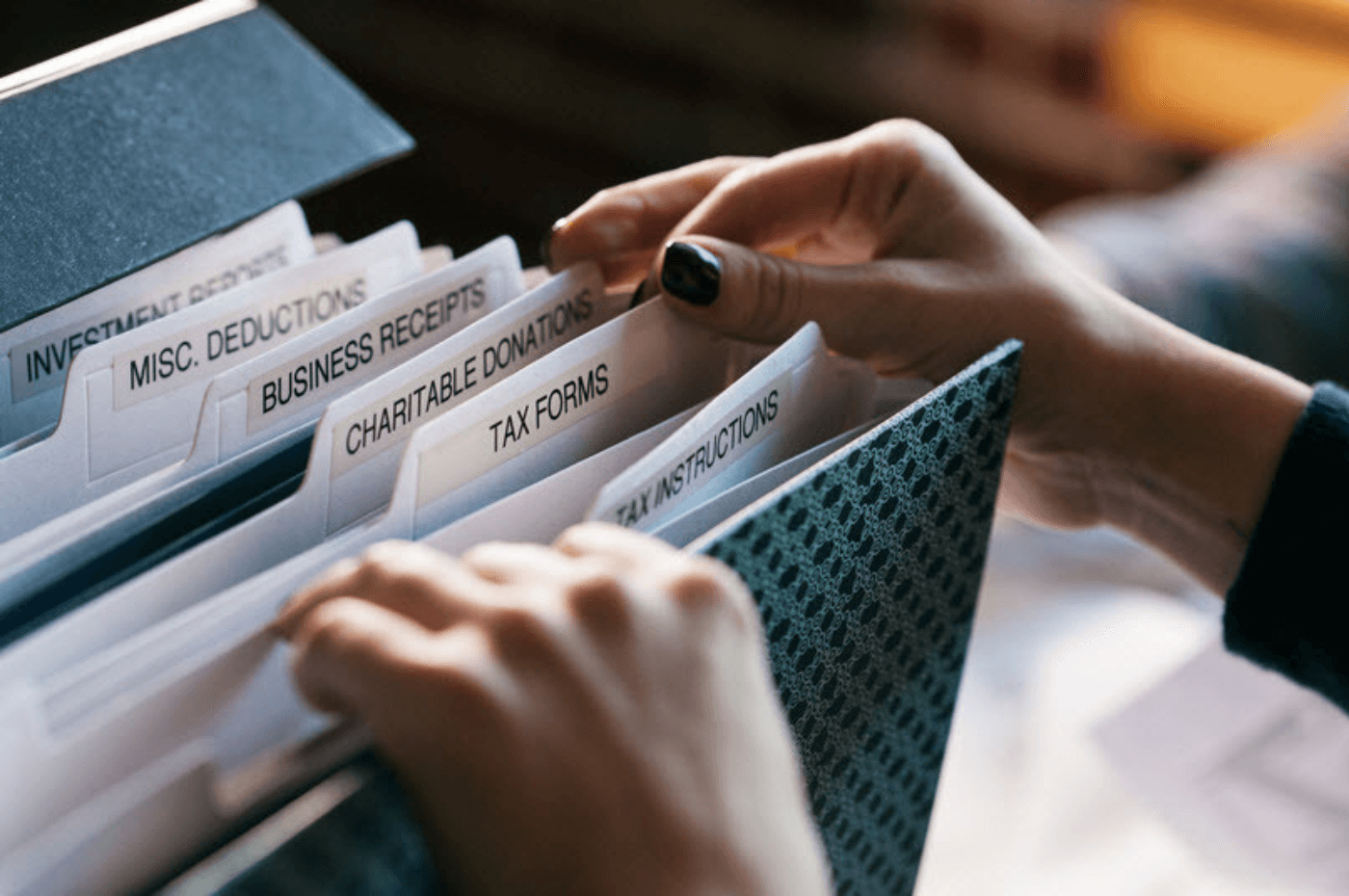

Key steps to staying organized include gathering all necessary tax documents, tracking important tax deadlines, and organizing financial records into categories.

How Organization Speeds Up Tax Refunds

For many taxpayers, a tax refund is one of the biggest checks they’ll receive all year, so filing early and correctly is key to getting that refund faster.

In addition to filing correctly, former IRS Commissioner Danny Werfe explains that the fastest way to get your tax refund is by filing electronically and picking direct deposit as your payment method. By doing this, “nine out of 10 taxpayers will see their refund within 21 days, and often sooner,” he says. Amended returns or those filed by mail can take up to four weeks — or longer if corrections are needed.

Charnell Ward from Pearl Lemon Tax, an international tax consulting firm that includes U.S. clients, says, “Early and organized tax filing reduces the possibility of delays brought on by errors, additional reviews, or missing data.”

Here’s what might happen with a disorganized tax filing:

Missing documents: Being disorganized makes it more likely you'll submit tax returns with missing forms.

Errors in the filing: Common issues include misspelled names, missing Social Security numbers, and unsigned returns — all of which can delay processing, according to the IRS.

Math errors: One of the most common refund delays is calculation errors, from entering figures incorrectly to incorrectly working out credits and deductions.

Miscommunication with tax preparers and accountants: Not having your documents organized in one location can make it challenging to keep an accurate overview of your taxes, which means your accountant or tax preparer won’t know either.

Avoid these common tax return mistakes by using a secure digital vault like Trustworthy's. With easy access, automated reminders, and a centralized location, you’re not left scrambling for scattered documents.

Key Steps to Stay Organized for Tax Season

Follow these steps to keep your documents organized year-round so you’re prepared for tax season.

Gather All Necessary Documents

A common reason for refund delays is missing documents. Avoid this by collecting essential tax forms, such as:

W-2: This is a report from your employer that outlines your wages, contributions to a health savings account, and contributions to a 401(k). You can request a copy directly from your employer or use the IRS' “Get Transcript” tool.

1099s: Report income from sources other than a traditional employer, such as freelancing, side jobs, or investments.

1099-MISC or 1099-NEC: These forms report side gig or freelance income if you earned more than $600.

1099-DIV and 1099-INT: These forms report dividends and interest earned from investments or savings accounts.

1098: This form is used to report tax-deductible expenses, such as mortgage interest paid (must meet the $600 interest threshold).

1095-A: This form is used to claim tax credits from the Affordable Care Act. It’s only required if you have marketplace health insurance.

Receipts for deductible expenses: These include charitable donations, medical expenses, and business expenses. Keep these receipts in a centralized and easy-to-access location with Trustworthy.

Prior year’s tax return: Useful for reference and any carryover deductions or credits. It is good practice to store at least three years of previous tax returns, but keeping them longer is recommended.

Childcare provider details: This form is necessary for claiming dependent care credits up to 35% of $3,000. Make sure all names are spelled correctly.

Be prepared for tax season by storing all your gathered documents with Trustworthy for easy access and unparalleled security.

How Trustworthy Can Help You Stay Organized

Eliminate last-minute stress by saving documents as soon as you receive them.

Trustworthy makes it easy to keep your records in order. You can store documents in a centralized location and use tags, notes, and smart search to quickly locate what you need — whether it’s a business expense, a medical receipt, or a charitable donation.

As you upload new files, Trustworthy automatically identifies related documents and creates smart links between them. For example, an updated insurance policy or mortgage statement will be grouped with other relevant records for quick reference when it’s time to file.

Store All of Your Documents in One Secure Place

When documents are scattered across emails and piled up on your desk, it’s very easy for things to go missing. That’s why making digital copies and storing them with Trustworthy is so important.

In addition to the predefined categories, the AI-powered Autopilot also has tools like document summaries, insights, and file naming suggestions to make storing your documents a breeze.

Trustworthy’s Chrome extension makes it easy to drag and drop files, save email attachments, and capture screenshots directly to your Trustworthy inbox.

Automated Reminders

By setting alerts for missing documents or upcoming deadlines using Trustworthy’s automated reminders, avoid paying penalties. Have a form you need to get a copy of? Let Trustworthy help you stay on track with those tasks.

Customizable Sharing

Trustworthy lets you securely share sensitive documents like W-2s, expense receipts, and tax returns with accountants or tax preparers. Simply create a network of trusted collaborators, such as family members, financial advisors, or accountants.

Control access by choosing full (view and edit) or partial (limited editing) permissions, making document sharing fast and secure.

For added flexibility, use SecureLinks™ to share tax documents with people outside your network. These unique, view-only links eliminate the hassle of email attachments and let you control who can access your files and for how long.

Accessibility and Security

Trustworthy comes with the added peace of mind that your documents are always secure and your tax documents can be accessed from anywhere and anytime. To keep your tax information safe, Trustworthy employs bank-level security measures like AES 256-bit encryption, multi-factor authentication, biometric authentication, physical security keys, and tokenization.

Benefits of Being Organized for Tax Season

Being organized means your information is accurate and you have claimed all eligible deductions to lower your tax liability. No errors result in faster refund processing.

Simplify tax preparation and avoid errors that could delay your refund by using Trustworthy's digital vault. With centralized storage, secure sharing, easy access, and automated reminders, you can focus on getting your refund quickly and efficiently.

Take the first step toward a more organized tax season by joining Trustworthy for free.

Frequently Asked Questions

What should I do if I make a mistake on my tax return?

If you catch a mistake on your tax return, file an amended return as soon as possible using Form 1040-X. Sometimes, the IRS will fix simple math mistakes for you. However, larger mistakes like excluding income will require an amended return.

How can I find out the status of my tax refund?

The IRS has a “Where’s My Refund?” tool online or on the mobile app to track your refund. This is a fast and easy tool to use.

Can I still get a refund if I didn’t earn enough to file taxes?

Yes, you may still be eligible for a refund if federal tax was withheld from your paycheck, and you may be eligible for refundable tax credits like the Child Tax Credit and Earned Income Tax Credit.

We’d love to hear from you! Feel free to email us with any questions, comments, or suggestions for future article topics.

Trustworthy is an online service providing legal forms and information. We are not a law firm and do not provide legal advice.