Your Social Security number (SSN) is one of the most important numbers assigned to you. Because people can use it to take out loans, open new credit, and receive government benefits, hackers and opportunists seek it out to steal your information.

This is why you should lock down your SSN if you know or suspect it’s compromised. But does this mean your SSN is really secure? In this guide, we’ll explore how and when to lock down your SSN and discuss further steps you can take to secure it.

Key Takeaways

Locking your SSN prevents anyone, including yourself, from accessing or changing your Social Security record.

You can lock your SSN by requesting all electronic access blocked by the SSA or using the E-Verify self-lock feature.

Signs that you should lock your SSN include incorrect information on credit reports, calls from debt collectors, suspicious messages, and depleted benefits.

Can You Lock Your Social Security Number?

Your SSN is the key to unlocking new loans from credit institutions and receiving important government benefits. It’s also used during identity verification to keep your personal information safe.

However, when this number is compromised, it’s important to lock your SSN immediately to prevent cyber criminals from committing identity theft.

You can lock your SSN yourself by using the government’s E-Verify program. This unique feature lets you protect your SSN by placing a “lock” on it.

For example, if you’re not currently working and want to prevent unauthorized persons from committing fraud, you can keep your SSN locked. Even if your employer enters your SSN into the database to confirm your work status, an E-Verify Tentative Nonconfirmation (mismatch) will be issued if your SSN is locked. The great thing about this self-lock feature is that you can unlock it any time.

Another way to lock your SSN is to request an electronic block from the Social Security Administration (SSA). Before you lock your SSN, remember that regardless of whether you use the self-lock option, you won’t be able to change or access your Social Security once the record is locked.

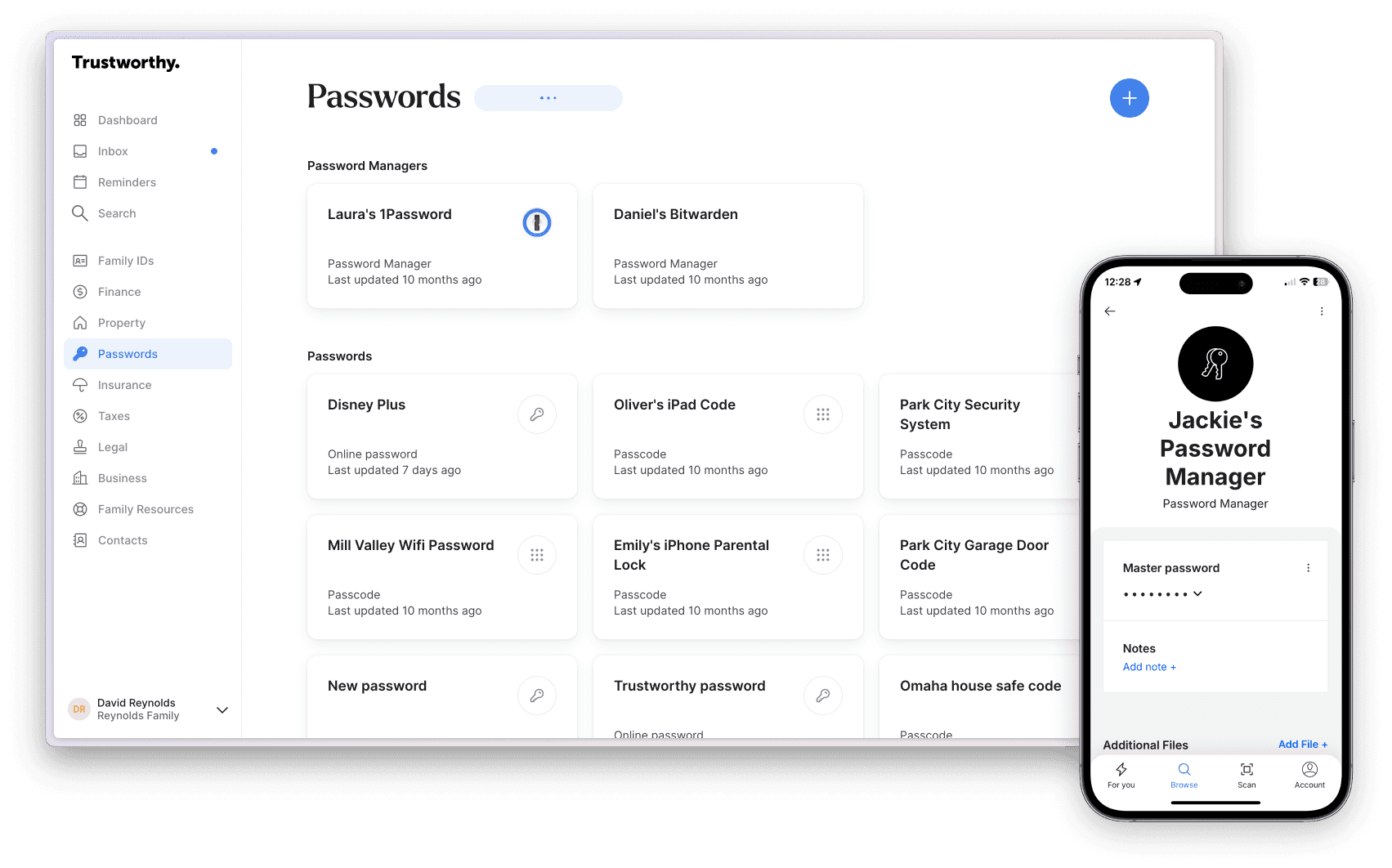

Prevent the hassle of a compromised SSN using a secure storage location like Trustworthy. Trustworthy is a family-operating system you can use to store your important information, such as your SSN, tax documents, financial records, and medical information. With easy-to-use features like access controls, Trustworthy should be your preferred cloud storage partner.

How to Lock Your SSN

Luckily, the process of locking your SSN is quite straightforward and can be done in two ways.

The first way to lock your SSN is to call the Social Security Administration at 800-772-1213 and request that electric access to your SSN be blocked. This means you cannot even access or change your SSN record.

The second method is a DIY option using the E-Verify feature. To use the self-lock feature, create or log into your myE-Verify account. To successfully lock your SSN, choose three challenge questions tol remember. This lock can be used for up to a year before it expires.

How to Unlock Your SSN

You can unlock your SSN with the E-Verify self-lock feature by answering the three challenge questions correctly. To unlock the electronic access block, you will need to request it from the SSA and provide proof of identity.

What Does a Social Security Number Lock Do?

Very simply, an SSN lock prevents anyone, including you, from being able to use your SSN for credit or employment-related fraud. Before locking your SSN, you should first consider the pros and cons.

One of the biggest benefits of locking your SSN is preventing fraudulent behavior using your SSN for credit or employment fraud. For example, the unauthorized person will not be able to receive any Social Security benefits when a lock is in place. Another benefit of locking your SSN is that it stops someone taking out loans and even mortgages in your name and leaving you with the bill.

While there are benefits to locking your SSN, one of the drawbacks of using this feature is that you are also locked from the SSN and cannot receive any Social Security benefits. If you haven’t unlocked your SSN, any loan applications you submit face rejection, as creditors cannot access your credit score. So, it’s important that you only lock your SSN when it makes sense to.

When Should You Lock Your Social Security Number?

Unfortunately, when it comes to knowing when to lock your SSN, it usually happens once your data is compromised, and sometimes, even then, it can be too late.

Phishing is a common attack used to obtain your SSN, and many of us won’t even notice when it happened. Here are some signs you should pay close attention to that may indicate that your SSN is stolen.

Incorrect Information on Credit Reports

One easy way to tell if your identity has been stolen is to look at your credit reports for anything unusual. Thieves will usually open new bank accounts, withdraw money, or apply for new loans under your name.

These will appear in your credit report. Sometimes, you may not spot a large transaction but several smaller ones to try and prevent you from getting suspicious. You can even hire credit monitoring services that periodically check your credit report on your behalf. This is a great idea if you want continuous monitoring.

Regardless of the amount, if you see any unrecognized financial activity, you need to lock your SSN and alert the police and credit bureaus.

Depleted Benefits

A strong indicator that someone has accessed your SSN is if your unemployment or disability income is denied. This usually means someone has used up all your benefits. In addition, you’ll also receive notifications about government benefits that you didn’t authorize. Don’t ignore these as spam, and regularly check your Social Security benefit statements.

Calls From Debt Collectors

If someone manages to get ahold of your SSN, they can carry out a number of financial transactions leaving you in the lurch and in some serious financial loss. From opening bank accounts and taking out new loans to withdrawing your savings and obtaining medical treatments, thieves can use your SSN in many ways. If you start receiving phone calls from debt collectors about bills for services you never authorized, this is a clear sign your identity is stolen, and you need to lock your SSN immediately.

Keep track of all your bills and financial statements with Trustworthy’s helpful finance tabs.

Tax Return Issues

If you’re filing your yearly tax return only for it to be rejected because it has already been filed, this is a sign that someone has access to your SSN and your tax return money. Keep an eye out for unusual discrepancies in your tax return form and notifications regarding suspicious activity from the Internal Revenue Service (IRS).

Suspicious Messages

We receive spam messages and emails on a daily basis. It’s easy to dismiss certain emails and messages as spam when they’re actually signs that your SSN is compromised. Watch out for messages about unpaid bills, rejected applications for loans you didn’t apply for, and requests for proof of employment for jobs you did not apply for. These are all signs of suspicious activity regarding your SSN.

Missing Mail

A couple of missing mail items are not overly concerning, as it’s not uncommon for things to get lost in the mail. However, noticing you’re no longer receiving mail from places you used to and haven't received any notifications about it can be very concerning. If someone accesses your SSN, they could have changed your address so you won’t receive notifications about new loans, accounts, and benefits used.

Further Steps to Secure Your SSN

Aside from locking your SSN, there are some other things that you can do to secure it, and some are easier than you think.

Use Trustworthy

Keep your SSN and other important information secure by using Trustworthy. This family-operating system makes storing documents, passwords, financial statements, and tax records easy. Trustworthy is SOC2 Type 2 and SOC3 certified with the American Institute of CPAs (AICPA) SOC standard and is serious about keeping your information safe.

Store Your Social Security Card Somewhere Safe

Keep your SSN safe by storing your Social Security card somewhere safe. Knowing your SSN is enough means you don’t need to carry your card. This way, it is less likely to get lost or stolen.

Shred Unneeded Documents With Your SSN

It’s good practice to shred any documents with your SSN that you no longer use. This could include old pay stubs, loan statements, tax returns, and medical bills. If you want to keep these documents, an alternative is to scan them into a secure storage cloud like Trustworthy.

Don’t Share Your SSN By Email or Text

While sharing information electronically has never been easier, the SSA recommends not sharing your SSN via email or text. This is because emails and texts can easily be hacked or intercepted, compromising your sensitive information.

Don’t Share Your SSN With Unsolicited Callers

A common scam involves thieves calling people pretending to be from the SSA to report a supposed problem with your account. They typically ask the caller to reveal their SSN. If you get a suspicious call or message, the best option is to contact the SSA directly.

Paige Hanson, the cyber safety education chief at NortonLifeLock, advises: "If you're not initiating the call, you should never share your personal information … even if it looks like it's coming from a legit company you do business with.”

Frequently Asked Questions

Is it a good idea to lock your Social Security number?

Locking your SSN is a good idea if you suspect that your SSN is compromised.

How much does it cost to lock your Social Security number?

There is no fee to lock your SSN, meaning you can lock your SSN for free.

Can someone use your Social Security number if it's locked?

No, your SSN cannot be used by anyone when it is locked, including yourself. You must unlock it for it to be used.

Can I lock my child's SSN?

If your child is under 16, you can request a free credit freeze for them.

We’d love to hear from you! Feel free to email us with any questions, comments, or suggestions for future article topics.

Trustworthy is an online service providing legal forms and information. We are not a law firm and do not provide legal advice.