Whether you want to send your credit card info to a family member or friend, you need a safe sending method. Text messages offer a quick and convenient way to send your credit card info.

But is it safe to send credit card info by text?

It is not entirely safe to send credit card info by text. Phone messages can be hacked, and phones can be stolen. Therefore, you put your credit card info at risk by sending it through text. Keep your credit card info safe through alternative platforms like Trustworthy, which is a highly secure digital storage platform.

You could face extreme consequences if your credit card info falls into the wrong hands. The risk of sending credit card info through a text message isn’t worth the convenience text messaging offers.

This guide will explain:

An overview of text messaging’s security and encryption.

If you should send credit card info by text.

Can you send credit card info through text securely.

5 tips for sending credit card info by text.

Texting vs. Trustworthy for sending credit card info.

Text Security and Encryption: Overview

Your text messages aren’t as secure and private as you’d think. This is because your cellular carrier can see your messages, cybercriminals can intercept your messages, and the government can monitor your messages. Furthermore, phone numbers are surprisingly easy to hijack.

When you send a text message through your cellular provider, it’s not encrypted because it’s sent over open networks. Therefore, hackers can intercept the data. Your cellular provider can also see the contents of your messages since the information is stored in their systems.

In terms of security protocols, text messaging is incredibly outdated and vulnerable to breaches and interceptions. Text messaging doesn’t offer end-to-end encryption, preventing third parties from viewing your data.

Should You Send Credit Card Info By Text?

You should never send credit card info by text. There are too many risks involved with sending credit card info through text, including phone theft and cyberattacks. Think about the consequences of a stolen credit card before sending your private info through a text message.

As I mentioned in the previous section, text messaging doesn’t offer advanced encryption protocols. Do you want multiple parties having access to your data, not knowing how secure their data management is?

However, the primary risk of sending credit card info by text is if you or the other person lose your phone or get it stolen. If your phone is stolen and the thief unlocks it, they can quickly find the credit card info you sent through text.

Let’s revisit all the risks of sending credit card info by text:

You or the recipient’s phone gets hacked.

You or the recipient’s phone gets stolen.

A hacker intercepts your text message.

A hacker breaches your cellular carrier’s servers.

Can You Send Credit Card Info Through Text Securely?

It’s not possible to send credit card info through text with 100% certainty that your data is safe and secure. However, you can implement more encryption to your text messages through iMessage or Android Messages.

If you and the recipient you want to share credit card info with have iPhones, you can use iMessage instead of a standard SMS text message. Apple’s iMessage uses end-to-end encryption. This means only you and the receiver can view the contents of the messages. However, you both need to have iPhones to use iMessage.

Similarly, Android phones have a feature called Messages, created by Google. However, this only works with Android phones, and both users need to have Messages enabled. If either of you doesn’t have Messages enabled, your texts won’t be protected with end-to-end encryption.

Although end-to-end encryption protects your data from cybercriminals, you or the recipient’s phone can get stolen or lost at any time. Therefore, you cannot send credit card info through text securely.

Tips for Sending Credit Card Info by Text

If you still want to send credit card info by text, here are five essential tips you should follow. These tips ensure as much protection as possible for credit card info sent over a text message.

1. Use a Secure Messaging App

Rather than using your standard text messaging app, you can use a third-party messaging app with end-to-end encryption.

A few noteworthy messaging apps include:

Telegram.

WhatsApp.

Signal.

All three of these apps use end-to-end encryption, ensuring only you and the recipient can view your messages. These messaging apps have a direct focus on security. This is because you can lock each app with a password, fingerprint, or facial recognition. This way, even if your phone gets stolen, the thief can’t access the credit card info you sent through the app.

2. Delete the Texts

It’s crucial to delete the text on your phone right after you press send. Since you don’t need to save your own credit card info, there is no reason to keep the info on your phone.

Furthermore, you should ask the recipient to delete the text message as soon as they don’t need it anymore. The longer the text messages containing your credit card info stay on your phones, the more exposed you are to credit card theft.

3. Don’t Send the Full Credit Card Number

You should never send your entire credit card number along with the expiration date and CVV. Instead, I recommend sending a partial piece of your credit card through text message. Then, you can send the rest of the credit card info through email or another messaging app.

4. Send Your Credit Card Info Through Phone Call

It’s much safer to send your credit card info through a phone call. However, it depends on how the receiver notes down your credit card. For example, if they input the credit card number directly into a payment page to purchase something online, your credit card info won’t be saved anywhere.

However, if they jot your credit card info on a sheet of paper or a computer document, you are putting the safety of your credit card info in their hands.

5. Secure Your Phone

You and the recipient of your credit card info must use secure locks on your phones. This way, thieves won’t be able to access the contents of your phone. In addition to a strong lock, you should reduce the amount of time it takes for your phone to auto-lock.

For example, you can set the Auto-Lock feature on iPhones to 30 seconds. This means that your phone will automatically lock after being idle for 30 seconds.

Texting vs. Trustworthy for Sending Credit Card Info

Don’t let your credit card info fall into the wrong hands. The convenience text messaging offers isn’t worth the risk of having your credit card info stolen.

Luckily, there’s a better solution called Trustworthy.

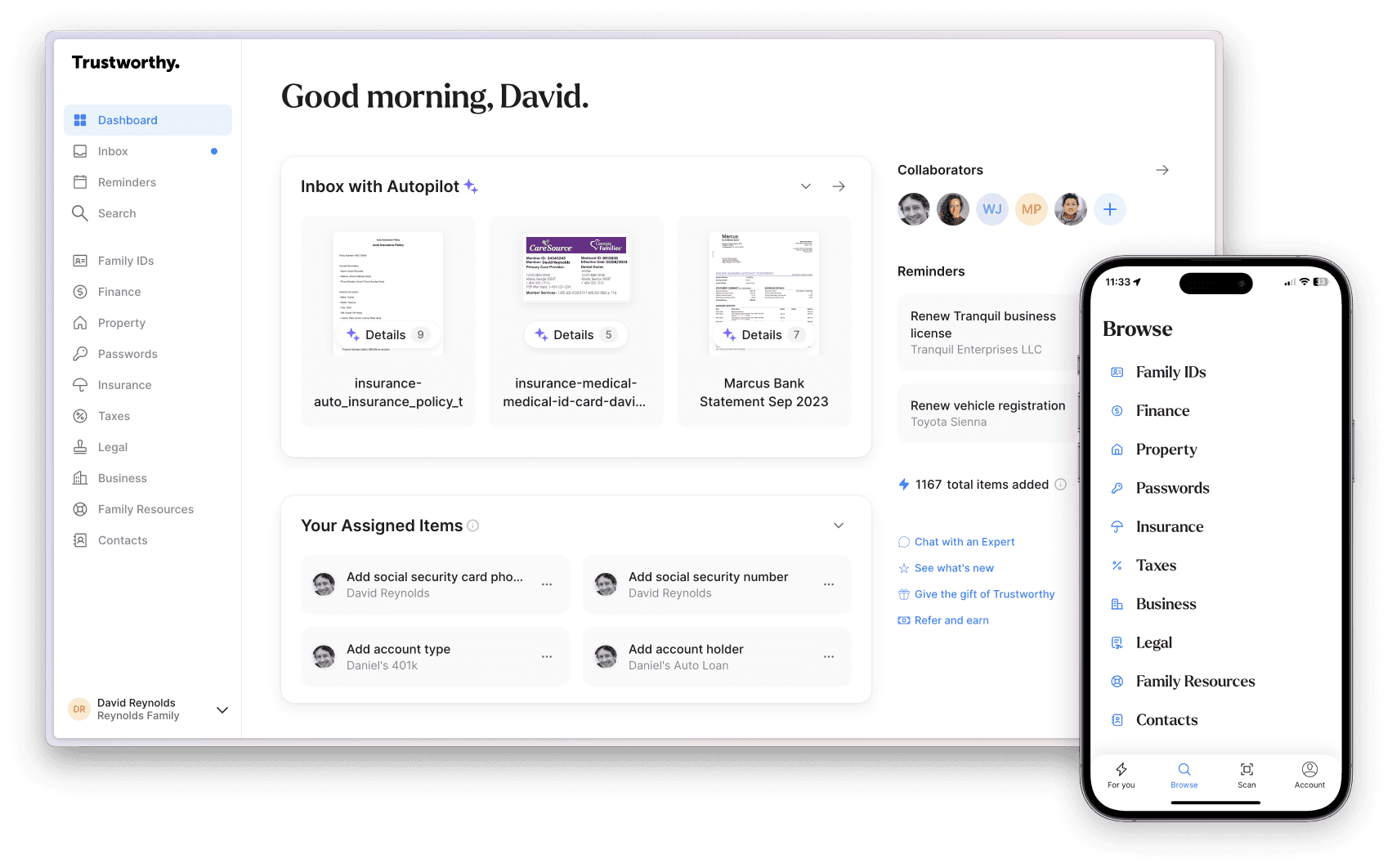

Trustworthy is a digital storage platform dedicated to securing and sharing confidential information. With Trustworthy, you can safely store and send credit card info, bank account info, personal IDs, account passwords, insurance documents, and much more.

In terms of security protocols, Trustworthy offers end-end data encryption and requires two-factor authentication. Therefore, you can share your credit card info with peace of mind knowing Trustworthy (Try it free) protects your data.

Other Credit Card Resources

We’d love to hear from you! Feel free to email us with any questions, comments, or suggestions for future article topics.

Trustworthy is an online service providing legal forms and information. We are not a law firm and do not provide legal advice.